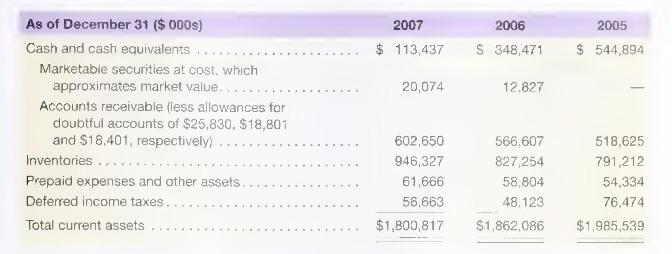

Following is the current asset section from the WW Grainger. Inc., balance sheet. Grainger reports the following

Question:

Following is the current asset section from the WW Grainger. Inc., balance sheet.

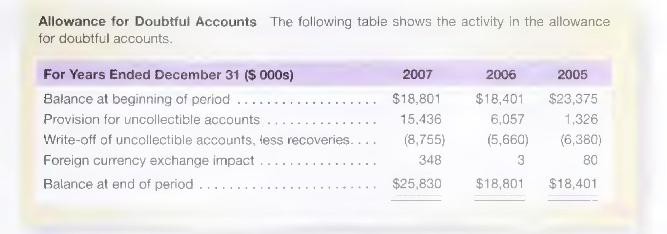

Grainger reports the following footnote relating to its receivables.

\section*{Required}

a. What amount do customers owe Grainger at each of the year-ends 2005 through 2007 ?

b. What percentage of its total accounts receivable does Grainger feel are uncollectible? (Hint. Percentage of uncollectible accounts \(=\) Allowance for uncollectible accounts/Gross accounts receivable)

c. What amount of bad debts expense did Grainger report in its income statement for each of the years 2005 through 2007?

d. Explain the change in the balance of the allowance for uncollectible accounts since 2005 Specifically, did the allowance increase or decrease as a percentage of gross accounts receivable. and why?

e. If Grainger had kept its 2007 allowance for uncollectible accounts at the same percentage of gross accounts receivable as it was in 2006, by what amount would its profit have changed (ignore taxes)? Explain.

f. Overall, what is your assessment of Grainger's allowance for uncollectible accounts and the related bad debis expense?

Step by Step Answer:

Financial Accounting For MBAs

ISBN: 9781934319345

4th Edition

Authors: Peter D. Easton, John J. Wild, Robert F. Halsey, Mary Lea McAnally