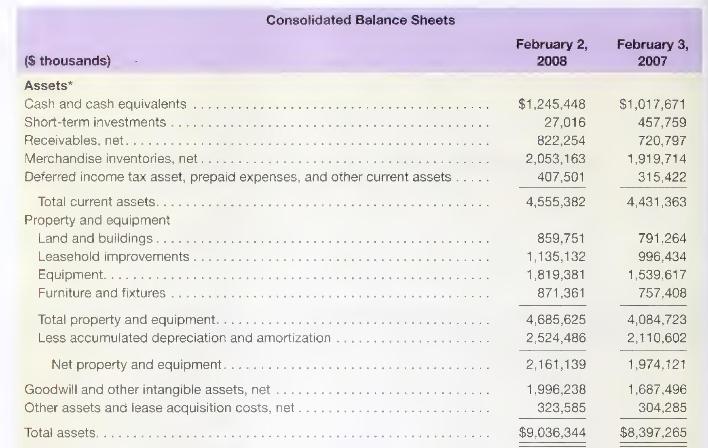

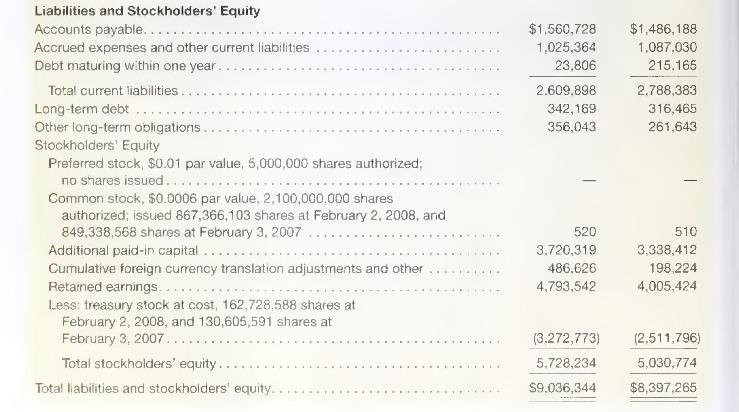

Following are the financial statements of Staples, Inc.} The balance sheet combines the following line items...

Question:

\\ Following are the financial statements of Staples, Inc.}

The balance sheet combines the following line items from the \(10-\mathrm{K}\) filing for brevity:

- Deferred income tax asset with Prepaid expenses and other current assets - Goodwill with Intangible assets, net of accumulated amortization - Lease acquisition costs, net of accumulated amortization with Other assets (noncurrent)

- Cumulative foreign currency translation adjustments with Minority interest

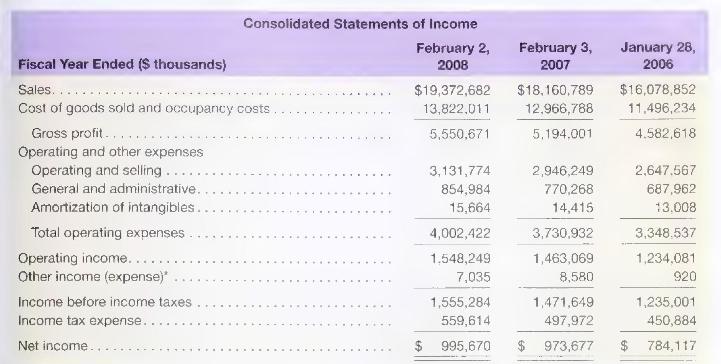

* This line item combines the following line items from the 10-K filing for brevity: Interest income and Interest expense with Miscellaneous expense and with Minority interests.

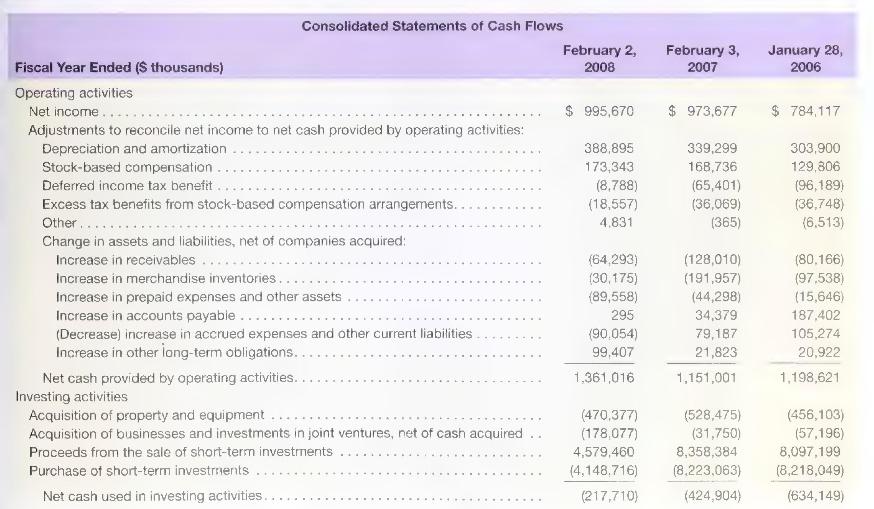

The following is a breakdown of 2008 depreciation and amortization expense ( \(\$\) thousands).

Staples provides the following footnote disclosures relating to its stock purchase program.

\begin{abstract}

Stockholders' Equity In fiscal 2007, the Company repurchased 31.6 million shares of the Company's common stock for a total purchase price (including commissions) of \(\$ 750.0\) million under the Company's 2005 and 2007 share repurchase programs. The 2007 share repurchase program replaced the \(2005 \$ 1.5\) billion share repurchase program (the "2005 Share Repurchase Program") and went into effect during the second quarter of 2007. The 2007 share repurchase program allows for the repurchase of \(\$ 1.5\) billion of Staples common stock and has no expiration date. In 2006, the Company repurchased 30.3 million shares of the Company's common stock for a total purchase price (including commissions) of \(\$ 749.9\) million. In 2005, the Company repurchased 30.1 million shares of the Company's common stock for a total purchase price (including commissions) of \(\$ 649.6\) million.

\end{abstract}

\title{

Required }

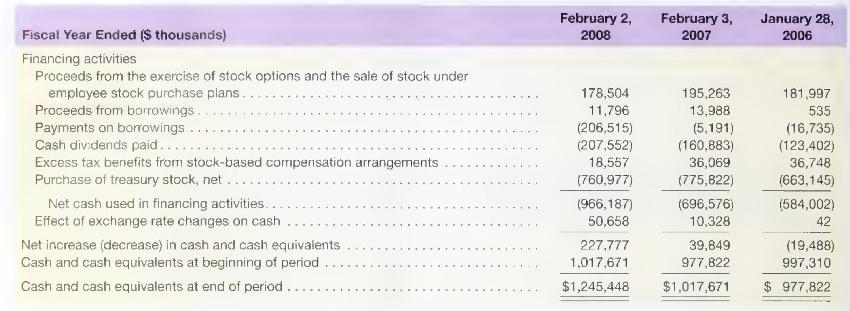

Forecast Staples' 2009 and 2010 income statements, balance sheets, and statements of cash flow; round forecasts to \(\$\) thousands. Use the same forecasting assumptions for both years; estimate forecasted income statement relations to 1 decimal (assume no change for: other assets, other long-term obligations, common stock, additional paid-in capital, and accumulated other comprehensive income). Staples' longterm debt footnote indicates maturities of \(\$ 4,023\) thousand in 2010 , and maturities of \(\$ 2,601\) thousand in 2011. Forecast an increase in interest income from investment of any excess cash, whether included in cash and cash equivalents or in marketable securities, under the assumption that any excess cash is invested whether or not separately classified as investments on the balance sheet. What investment or financing assumptions are required for forecasting purposes? (Hint: Consider Staples' stock repurchase footnote.) What is our assessment of Staples' financial condition over the next two years?

Step by Step Answer:

Financial Accounting For MBAs

ISBN: 9781934319345

4th Edition

Authors: Peter D. Easton, John J. Wild, Robert F. Halsey, Mary Lea McAnally