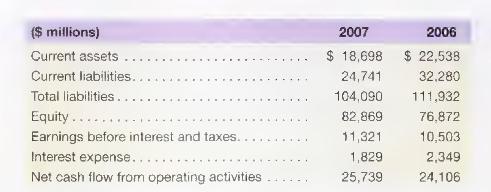

Selected balance sheet and income statement information from Verizon follows. a. Compute the current ratio for each

Question:

Selected balance sheet and income statement information from Verizon follows.

a. Compute the current ratio for each year and discuss any trend in liquidity. What additional information about the numbers used to calculate this ratio might be useful in helping us assess liquidity? Explain.

b. Compute times interest earned, the liabilities-to-equity, and the net cash from operating activities to total liabilities ratios for each year and discuss any noticeable change. (The average liabilitiesto-equity ratio for the telecommunications industry is 1.70.) Do you have any concerns about the extent of Verizon's financial leverage and the company's ability to meet interest obligations? Explain.

c. Verizon's capital expenditures are expected to increase substantially as it seeks to respond to competitive pressures to upgrade the quality of its communication infrastructure. Assess Verizon's liquidity and solvency in light of this strategic direction.

Step by Step Answer:

Financial Accounting For MBAs

ISBN: 9781934319345

4th Edition

Authors: Peter D. Easton, John J. Wild, Robert F. Halsey, Mary Lea McAnally