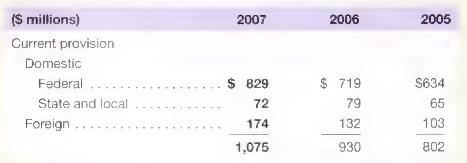

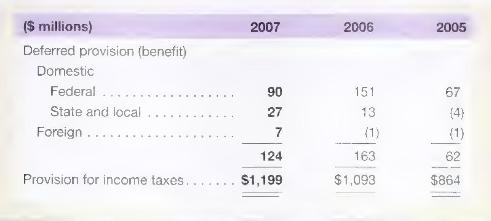

The income tax footnote to the financial statements of FedEx Corporation follows. The components of the provision

Question:

The income tax footnote to the financial statements of FedEx Corporation follows.

The components of the provision for income taxes for the years ended May 31 were as follows:

a. What is the amount of income tax expense reported in FedEx's 2007, 2006 and 2005 income statements?

b. What percentage of total tax expense is currently payable in each of 2005,2006 , and 2007? Explain why the percentages are different each year.

c. One possible reason for the \(\$ 90\) million federal deferred tax expense in 2007 is that deferred tax liabilities increased during that year. Provide an example that gives rise to an increase in the deferred tax liability.

Step by Step Answer:

Financial Accounting For MBAs

ISBN: 9781934319345

4th Edition

Authors: Peter D. Easton, John J. Wild, Robert F. Halsey, Mary Lea McAnally