Mondao Computing is considering an investment of $2.3 million in new equipment. The predicted cash inflows and

Question:

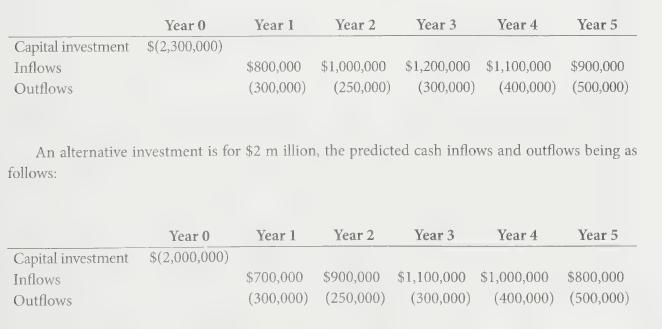

Mondao Computing is considering an investment of $2.3 million in new equipment. The predicted cash inflows and outflows are as shown below:

Mondao depreciates its equipment over five years and uses a cost of capital of 12%.

a. For each of the investment alternatives, calculate the 1. Net present value 2. Payback 3. Accounting rate of return (on an average basis, not per year)

b. Recommend, with reasons, which of the investment proposals should be approved.

c. Compare and contrast net present value, payback, and accounting rate of return as methods of capital investment appraisal. What are the strengths and limitations of each method?

Step by Step Answer:

Accounting For Managers Interpreting Accounting Information For Decision Making

ISBN: 9781118037966

1st Canadian Edition

Authors: Paul M. Collier, Sandy M. Kizan, Eckhard Schumann