On January 1, Mitzu Co. pays a lump-sum amount of $2,600,000 for land, Building 1, Building 2,

Question:

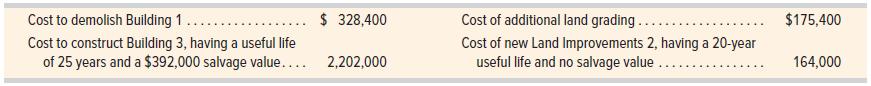

On January 1, Mitzu Co. pays a lump-sum amount of $2,600,000 for land, Building 1, Building 2, and Land Improvements 1. Building 1 has no value and will be demolished. Building 2 will be an office and is appraised at $644,000, with a useful life of 20 years and a $60,000 salvage value. Land Improvements 1 is valued at $420,000 and is expected to last another 12 years with no salvage value. The land is valued at $1,736,000. The company also incurs the following additional costs.

Required

1. Prepare a table with the following column headings: Land, Building 2, Building 3, Land Improvements 1, and Land Improvements 2. Allocate the costs incurred by Mitzu to the appropriate columns and total each column.

2. Prepare a single journal entry to record all the incurred costs assuming they are paid in cash on January 1.

3. Using the straight-line method, prepare the December 31 adjusting entries to record depreciation for the first year these assets were in use.

Step by Step Answer:

Financial Accounting Information For Decisions

ISBN: 9781260705584

10th Edition

Authors: John J. Wild