It is May 30th, 2022 and you are the Vice President in charge of risk management for Beasties Fund Inc., a funds management company

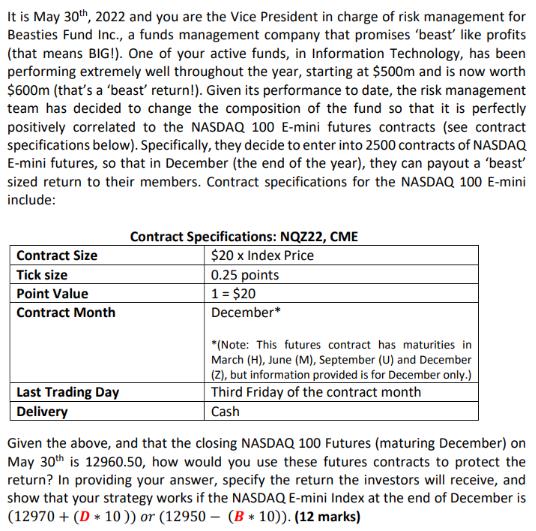

It is May 30th, 2022 and you are the Vice President in charge of risk management for Beasties Fund Inc., a funds management company that promises 'beast' like profits (that means BIG!). One of your active funds, in Information Technology, has been performing extremely well throughout the year, starting at $500m and is now worth $600m (that's a 'beast' return!). Given its performance to date, the risk management team has decided to change the composition of the fund so that it is perfectly positively correlated to the NASDAQ 100 E-mini futures contracts (see contract specifications below). Specifically, they decide to enter into 2500 contracts of NASDAQ E-mini futures, so that in December (the end of the year), they can payout a 'beast' sized return to their members. Contract specifications for the NASDAQ 100 E-mini include: Contract Size Tick size Point Value Contract Month Last Trading Day Delivery Contract Specifications: NQZ22, CME $20 x Index Price 0.25 points 1 = $20 December* *(Note: This futures contract has maturities in March (H), June (M), September (U) and December (2), but information provided is for December only.) Third Friday of the contract month Cash Given the above, and that the closing NASDAQ 100 Futures (maturing December) on May 30th is 12960.50, how would you use these futures contracts to protect the return? In providing your answer, specify the return the investors will receive, and show that your strategy works if the NASDAQ E-mini Index at the end of December is (12970+ (D 10)) or (12950 (B * 10)). (12 marks) *

Step by Step Solution

3.52 Rating (152 Votes )

There are 3 Steps involved in it

Step: 1

To protect the return of the Information Technology fund we can use the NASDAQ 100 Emini futures contracts to create a perfectly positively correlated ...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started