Question

Solve the following. Table 9.2 Average Returns for Bonds 1950 to 1959 1960 to 1969 1970 to 1979 1980 to 1989 1990 to 1999 2000

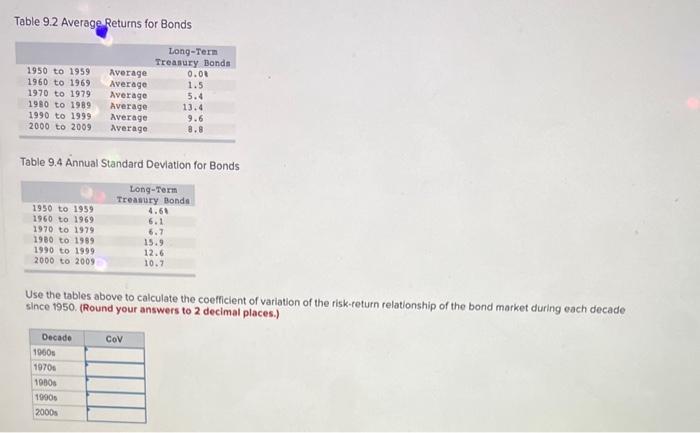

Solve the following.

Table 9.2 Average Returns for Bonds 1950 to 1959 1960 to 1969 1970 to 1979 1980 to 1989 1990 to 1999 2000 to 2009 1950 to 1959 1960 to 1969 1970 to 1979 1980 to 1989 1990 to 1999 2000 to 2009 Table 9.4 Annual Standard Deviation for Bonds Decade Average Average Average Average Average Average 1960s 1970 1980s 1990s 2000s Long-Term Treasury Bonds Cov 0.00 1.5 5.4 13.4 Long-Term Treasury Bonds 4.61 6.1 6.7 Use the tables above to calculate the coefficient of variation of the risk-return relationship of the bond market during each decade since 1950. (Round your answers to 2 decimal places.) 9.6 8.8 15.9 12.6 10.7

Step by Step Solution

There are 3 Steps involved in it

Step: 1

The formula to calculate coefficient of ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Fundamentals of Investments, Valuation and Management

Authors: Bradford Jordan, Thomas Miller, Steve Dolvin

8th edition

1259720697, 1259720691, 1260109437, 9781260109436, 978-1259720697

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App