(Payback, ARR, NPV) Tropic Investments is considering a project involving an initial cash outlay for an asset...

Question:

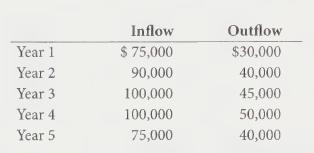

(Payback, ARR, NPV) Tropic Investments is considering a project involving an initial cash outlay for an asset of $200,000. The asset is depreciated over five years at 20% per year (based on the value of the investment at the beginning of each year). The cash flows from the project are expected to be as follows:

a. What is the payback period?

b. What is the return on investment (each year and average)?

c. Assuming a cost of capital of 10% and ignoring inflation, what is the net present value of the cash flows?

d. Should the project be accepted?

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Accounting For Managers Interpreting Accounting Information For Decision Making

ISBN: 9781118037966

1st Canadian Edition

Authors: Paul M. Collier, Sandy M. Kizan, Eckhard Schumann

Question Posted: