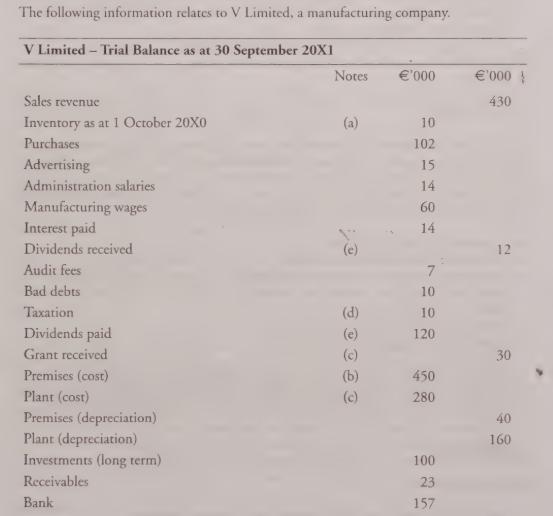

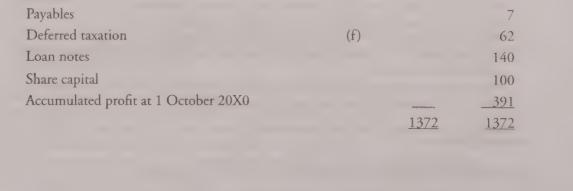

Additional Information (a) Inventory was worth 13,000 on 30 September 20X1. (b) Premises consist of land costing

Question:

Additional Information

(a) Inventory was worth €13,000 on 30 September 20X1.

(b) Premises consist of land costing €250,000 and buildings costing €200,000. The buildings have an expected useful life of 50 years.

(c) Plant includes an item purchased during the year at a cost of €70,000. A government grant of €30,000 was received in respect of this purchase. These were the only transactions involving non-current assets during the year. Depreciation of plant is to be charged at 10 per cent per annum on a straight-line basis.

(d) The balance on the tax account is an under-provision for tax brought forward from the year ended 30 September 20X0.

(e) The company paid €48,000 on 27 November 20X0 as a final dividend for the year ended 30th September 20X0. A dividend of €12,000 was received on 13 January 20X1 (record the €12,000 received with no adjustment). The 20X1 interim dividend of €72,000 was paid on the 15th April 20X1.

(f) The provision for deferred tax is to be reduced by €17,000.

(g) The directors have estimated that tax of €57,000 will be due on the profits for this year.

(h) The directors have proposed a final dividend for the year of €50,000.

(i) It is company policy to charge depreciation to cost of sales.

Requirement Prepare a statement of comprehensive income for V Limited for the year ended 30th September 20X1 and a statement of financial position at that date. These should be in a form suitable for presentation to the shareholders and be accompanied by notes to the accounts in so far as is possible from the information provided.

Step by Step Answer:

International Financial Accounting And Reporting

ISBN: 9780903854726

2nd Edition

Authors: Ciaran Connolly