e The company had two financial assets, X and Y, classified as available-for-sale as at 31 December

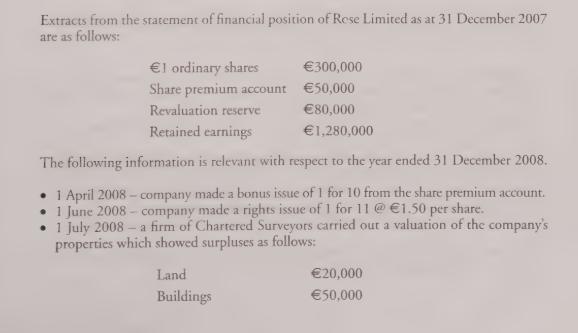

Question:

e The company had two financial assets, X and Y, classified as available-for-sale as at 31 December 2007:

o X — after classification as available for sale the fair value of this asset increased by €30,000. This was recognized through equity in the year ended 31 December 2007.

The asset was sold during the year under review; and o Y —this asset was classified as available for sale during the year ended 31 December 2007 and valued at fair value less cost to sell. During the year under review the fair}

value increased by €10,000.

e Profit after tax for year ended 31 December 2008 amounted to €120,000.

e Proposed (and approved by shareholders prior to end of reporting period) dividends for year ended 31 December 2008 amounted to €25,000.

e During 2008, Rose Limited changed its accounting policy for the treatment of borrowing costs that are directly attributable to the acquisition of property, plant and equipment. In previous periods, Rose Limited had capitalized such costs. The company now treats these costs as an expense. Management judges that the new policy is preferable because it results in a more transparent treatment of finance costs and is consistent with local industry practice, making Rose Limited’s financial statements more comparable.

The company had capitalized €35,000 borrowing costs to 31 December 2007.

Requirement Prepare the statement of changes in equity for the year ended 31 December 2008 for Rose Limited.

Step by Step Answer:

International Financial Accounting And Reporting

ISBN: 9780903854726

2nd Edition

Authors: Ciaran Connolly