Compute the debt-to-equity ratio for each of the following companies. Which company appears to have a riskier

Question:

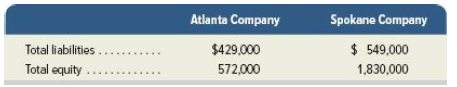

Compute the debt-to-equity ratio for each of the following companies. Which company appears to have a riskier financing structure? Explain.

Transcribed Image Text:

Atlanta Company Spokane Company $ 549,000 1,830,000 Total liabilities. $429,000 572,000 Total equity

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 100% (9 reviews)

Ratio of debt to equity Atlanta Company Spokane Company Tot...View the full answer

Answered By

Ashington Waweru

I am a lecturer, research writer and also a qualified financial analyst and accountant. I am qualified and articulate in many disciplines including English, Accounting, Finance, Quantitative spreadsheet analysis, Economics, and Statistics. I am an expert with sixteen years of experience in online industry-related work. I have a master's in business administration and a bachelor’s degree in education, accounting, and economics options.

I am a writer and proofreading expert with sixteen years of experience in online writing, proofreading, and text editing. I have vast knowledge and experience in writing techniques and styles such as APA, ASA, MLA, Chicago, Turabian, IEEE, and many others.

I am also an online blogger and research writer with sixteen years of writing and proofreading articles and reports. I have written many scripts and articles for blogs, and I also specialize in search engine

I have sixteen years of experience in Excel data entry, Excel data analysis, R-studio quantitative analysis, SPSS quantitative analysis, research writing, and proofreading articles and reports. I will deliver the highest quality online and offline Excel, R, SPSS, and other spreadsheet solutions within your operational deadlines. I have also compiled many original Excel quantitative and text spreadsheets which solve client’s problems in my research writing career.

I have extensive enterprise resource planning accounting, financial modeling, financial reporting, and company analysis: customer relationship management, enterprise resource planning, financial accounting projects, and corporate finance.

I am articulate in psychology, engineering, nursing, counseling, project management, accounting, finance, quantitative spreadsheet analysis, statistical and economic analysis, among many other industry fields and academic disciplines. I work to solve problems and provide accurate and credible solutions and research reports in all industries in the global economy.

I have taught and conducted masters and Ph.D. thesis research for specialists in Quantitative finance, Financial Accounting, Actuarial science, Macroeconomics, Microeconomics, Risk Management, Managerial Economics, Engineering Economics, Financial economics, Taxation and many other disciplines including water engineering, psychology, e-commerce, mechanical engineering, leadership and many others.

I have developed many courses on online websites like Teachable and Thinkific. I also developed an accounting reporting automation software project for Utafiti sacco located at ILRI Uthiru Kenya when I was working there in year 2001.

I am a mature, self-motivated worker who delivers high-quality, on-time reports which solve client’s problems accurately.

I have written many academic and professional industry research papers and tutored many clients from college to university undergraduate, master's and Ph.D. students, and corporate professionals. I anticipate your hiring me.

I know I will deliver the highest quality work you will find anywhere to award me your project work. Please note that I am looking for a long-term work relationship with you. I look forward to you delivering the best service to you.

3.00+

2+ Reviews

10+ Question Solved

Related Book For

Financial Accounting Information for Decisions

ISBN: 978-1259917042

9th edition

Authors: John J. Wild

Question Posted:

Students also viewed these Business questions

-

Calculate the debt to equity ratio for Blue Line Studio Inc. Below is an excerpt from their balance sheet line items: Current liabilities 342,000 Long-term debt 688,000 Total equity 750,000 a....

-

a. Calculate the debt to equity ratio for 2019 and 2020, for the following three separate companies. b. Comment on whether the ratio for each has improved or weakened from a risk perspective. Outdoor...

-

The debt to equity ratio of four companies is given below. Debt to equity ratio Lewis, Inc. 1.30 Jackson, Inc. 1.50 Jones Corp. 0.88 Roberts Corp. 0.92 Which of the following companies has the...

-

It is desired to control the exit temperature T2 of the beat exchanger shown In Figure by adjusting the steam flow rate w3, unmeasured disturbances occur in inlet temperature T1. The dynamic behavior...

-

What are the contrasting roles of trithorax and polycomb group complexes during development in animals and plants?

-

Explain why offline communications are significant. What should be their aims?

-

Forbes (June 3, 1985) points out that companies wishing to protect their credit ratings and unwilling to issue more stock are raising capital by issuing hybrid securities. The article specif ically...

-

Billing Enterprises purchases a 90% interest in the common stock of Rush Corporation on January 1, 2011, for an agreed-upon price of $495,000. Billing issues $400,000 of bonds to Rush shareholders...

-

Please help me answer in 1 hour. Thanks, I will give you good rating QUESTION 3 (37 marks) Benson Company adjusts it account at the end of each year. The following information concerns the adjusting...

-

Aubrae and Tylor Williamson began operations of their furniture repair shop (Furniture Refinishers, Inc.) on January 1, 2019. The annual reporting period ends December 31. The trial balance on...

-

Stanford issues bonds dated January 1, 2018, with a par value of $500,000. The bonds annual contract rate is 9%, and interest is paid semiannually on June 30 and December 31. The bonds mature in...

-

On January 1, 2018, MM Co. borrows $340,000 cash from a bank and in return signs an 8% installment note for five annual payments of $85,155 each, with the first payment due one year after the note is...

-

Ian retired in June of 2019 at the age of 71. Ians retirement account was valued at $490,000 at the end of 2018 and $500,000 at the end of 2019. He has had all of his retirement accounts open for 15...

-

Use your own academic report, issued by your institute, as an example. Ask a database administrator how they use normalization steps to transform the details of the report into a set of relations in...

-

Francis Corp. has two divisions, Eastern and Western. The following information for the past year is for each division: Francis has established a hurdle rate of 9 percent. Required: 1. Compute each...

-

The enzyme lipase catalyzes the hydrolysis of esters of fatty acids. The hydrolysis of p-nitrophenyloctanoate was followed by measuring the appearance of p-nitrophenol in the reaction mixture: The...

-

Use values of r cov (Table 17.1) to estimate the XY bond lengths of ClF, BrF, BrCl, ICl and IBr. Compare the answers with values in Fig. 17.8 and Table 17.3, and comment on the validity of the method...

-

From a square whose side has length \(x\), measured in meters, create a new square whose side is \(10 \mathrm{~m}\) longer. Find an expression for the sum of the areas of the two squares as a...

-

A radioactive substance of mass 100 g is decaying such that after t days the amount remaining, M, is given by the equation M = 100e 0.002t . a. Sketch the graph of M against t. b. What is the...

-

Use multiplication or division of power series to find the first three nonzero terms in the Maclaurin series for each function. y = e x2 cos x

-

Refer to Decision Maker, Purchase Manager, in this chapter. Assume that you are the motorcycle manufacturers managerial accountant. The purchasing manager asks you about preparing an estimate of the...

-

CCMD Company makes specialty skates for the ice skating circuit. On December 31, 2008, the company had (a) 1,500 skates in finished goods inventory and (b) 2,500 blades at a cost of $15 each in raw...

-

Shown here are annual financial data at December 31, 2009, taken from two different companies. Required 1. Compute the cost of goods sold section of the income statement at December 31, 2009, for...

-

Harper, Inc, acquires 40 percent of the outstanding voting stock of Kinman Company on January 1, 2020, for $316,100 in cash. The book value of Kinman's net assets on that date was $610.000, although...

-

Need a help for this! The following information is obtained from the records of Kaiser Company: On January 1, 2017 the following machines were acquired for cash: Production machines costs $ 6,000...

-

Book 51,500 Hint rint rences Raw Materials Inventory Debit Credit Beginning 10,100 Purchases 45,500 Available for use 55,600 DM used Ending 4,100 Work in Process Inventory Debit Credit Beginning...

Study smarter with the SolutionInn App