Grotto Limited makes up its accounts to 31 December each year. Its research and development expenditure for

Question:

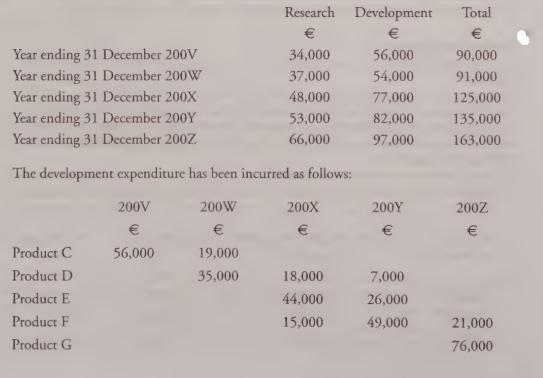

Grotto Limited makes up its accounts to 31 December each year. Its research and development expenditure for the years ending 31 December is as follows:

The accounting policy for research and development expenditure has been in accordance with the requirements of IAS 38 Intangible Assets. Development expenditure is recognized as an intangible asset when the conditions of IAS 38 are met. In applying this policy, the directors write off the development expenditure in relation to estimated sales of the product (in units). Arising from this policy, in the accounts for the four years to 31 December 200Y, research expenditure in the amount of €172,000 has been written off. Development expenditure has been written off as follows:

e Product C: €50,000 has been written off. Sales of this product are at a standstill and are not expected to recover.

e Product D: All the development expenditure on this product has been written off because it was a failure. Sales of only 20,000 units were made in 200Y and prospects of further sales appeared slight. However, it now appears that sales of this product are picking up, sales of 45,000 units being expected for 200Z and further sales of approximately 250,000 units being anticipated in later years.

e Product E: In 200Y 48,000 units of product E were sold. It was then estimated that approximately 200,000 further*units would be sold over the next four years and that the sales would occur fairly evenly over that period. Arising from this, €14,000 of the expenditure was written off in 200Y. Sales in 200Z should amount to approximately 30,000 units. Estimated further sales in the next two years are expected to total 70,000 units approximately. No further sales are expected in the years after this.

e Product F: It is considered that approximately 600,000 units of this product will be sold in total of which approximately 80,000 units will be sold in 200Z.

e Product G: This product is still in the course of development. However since there have been consumer association objections to a similar product in the USA, certain revisions are being considered to this product. It is not yet known how successful or how costly these revisions will prove to be.

Requirement

(a) Outline the accounting concepts you would have considered in accounting for research and development expenditure before any accounting standard was issued on the topic.

(b) Estimate the charge for research and development expenditure in the accounts of Grotto Limited for the year ended 31 December 200Z and illustrate the disclosure of that expenditure in accordance with IAS 38 Intangible Assets.

Step by Step Answer:

International Financial Accounting And Reporting

ISBN: 9780903854726

2nd Edition

Authors: Ciaran Connolly