Question:

Ike issues $180,000 of 11%, three-year bonds dated January 1, 2018, that pay interest semiannually on June 30 and December 31. They are issued at $184,566. Their market rate is 10% at the issue date.

Required

1. Prepare the January 1, 2018, journal entry to record the bonds issuance.

2. Determine the total bond interest expense to be recognized over the bonds? life.

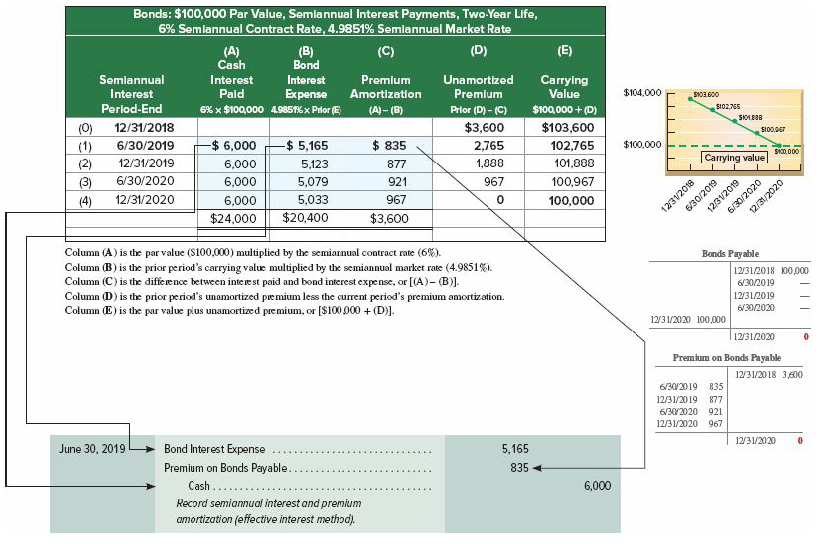

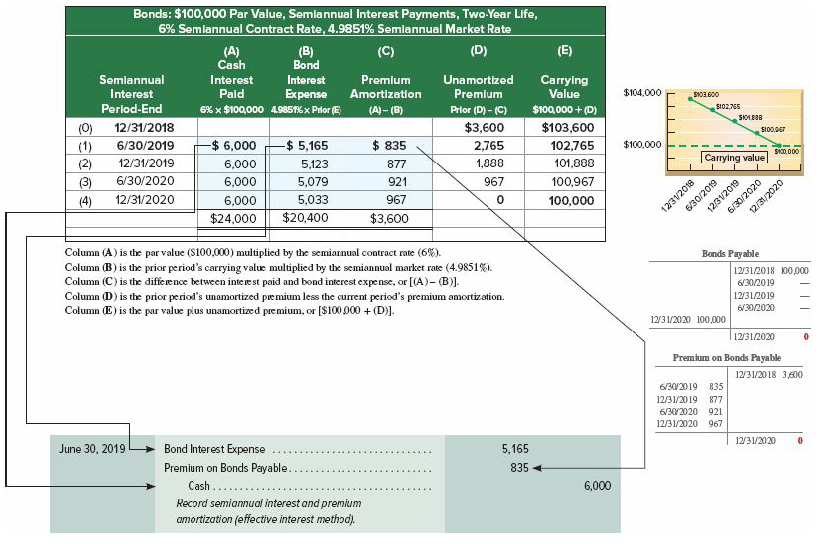

3. Prepare an effective interest amortization table like Exhibit 10B.2 for the bonds? first two years.

4. Prepare the journal entries to record the first two interest payments.

5. Prepare the journal entry to record the bonds? retirement on January 1, 2020, at 98.

6. Assume that the market rate on January 1, 2018, is 12% instead of 10%. Without presenting numbers, describe how this change affects the amounts reported on Ike?s financial statements.

Transcribed Image Text:

Bonds: $100,000 Par Value, Semlannual Interest Payments, Two-Year Life, 6% Semlannual Contract Rate, 4.9851% Semlannual Market Rate (A) Cash (C) (D) (E) (B) Bond Semiannual Interest Pald Interest Premium Unamortized Carrying Value $104,000 Interest Expense 6% x $100,000 4.9851% x Prior (E Amortization Premium 009 EOIS S102,765 Period-End Prior (D) - (C) $100,000 + (D) (A) - (B) SIOLES8 $3,600 $103,600 102,765 (0) (1) (2) 12/31/2018 SIO0,0E7 $ 6,000 $ 835 $100,000 -$ 5,165 6/30/2019 2,765 SI00.000 Carrying value 12/31/2019 1,000 101,888 6,000 5,123 877 6/30/2020 6,000 (3) (4) 5,079 921 967 100,967 12/31/2020 5,033 967 6,000 100,000 630/2019 12/31/2020 $20,400 $24,000 $3,600 Column (A) is the par value (S100,000) multiplied by the semiarnual contract rate (6%). Column (B) is the prior period's carrying value multiplied by the semiannual market rate (4.9851%i. Column (C) is the difference between interest paid and bond interest expense, or [(A)- (B)). Column (D) is the prior period's unamortized premium less the current period's premium amortization. Column (E) is the par value plus unamortized pre mium, or [$100 000 + (D). Bonds Payable 12/31/2018 100,000 6/30/2019 12/31/2019 6/30/2020 12/31/2020 100,000 12/31/2020 Premium on Bonds Payable 12/31/2018 3,600 6/30/2019 835 12/31/2019 877 6/302020 921 12/31/2020 967 12/31/2020 Bond Interest Expense June 30, 2019 5,165 Premium on Bonds Payable. 835 Cash ... 6,000 Record semiannual interest and premium amortization (effective interest method). 123V2018 123V2019 6/30/2020