You have just been given the fixed assets section from the audit file of WELLER Limited (WELLER)

Question:

You have just been given the fixed assets section from the audit file of WELLER Limited

(WELLER) in relation to the financial statements for the year ended 31 December 2008 with a note from the partner-in-charge asking you to clear the outstanding review points.

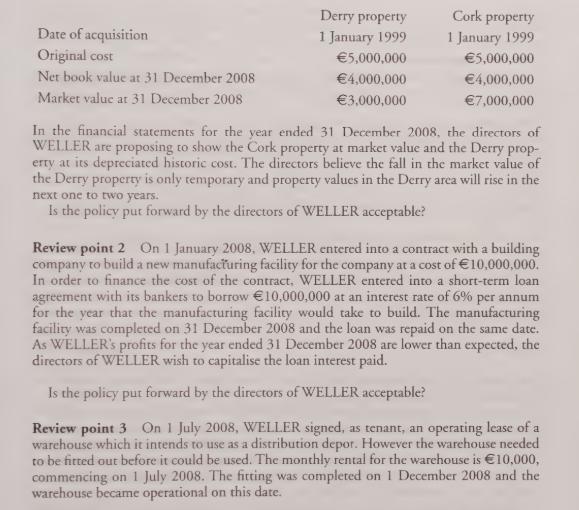

Review point 1 WELLER owns two freehold properties, one in Derry and the other in Cork. The company uses both as regional administrative offices. The properties had an expected useful life of 50 years on their date of acquisition, and the directors believe that this assumption is still appropriate at 31 December 2008. It is company policy to depreciate the properties on a straight-line basis over their estimated useful economic life.

out period together with the cost of the fixtures and fittings.

out period together with the cost of the fixtures and fittings.

Is the policy put forward by the directors of WELLER acceptable?

Review point 4 TAYLOR Limited (TAYLOR) is also an audit client of your firm. The company operates in the same business as WELLER and is similar in size. Both companies purchased identical equipment from the same supplier on 1 January 2007 at a cost of €6,000,000. Shown below are extracts from the fixed assets notes of both companies in respect of this equipment.

Are there valid reasons for the policy of non-depreciation of freehold land?

Requirement Prepare a memorandum addressed to the partner-in-charge of the audit of WELLER addressing the issues raised in each of the review points.

Step by Step Answer:

International Financial Accounting And Reporting

ISBN: 9780903854726

2nd Edition

Authors: Ciaran Connolly