Jackson owns a retail shop. From the few records he keeps the following information is avail- able

Question:

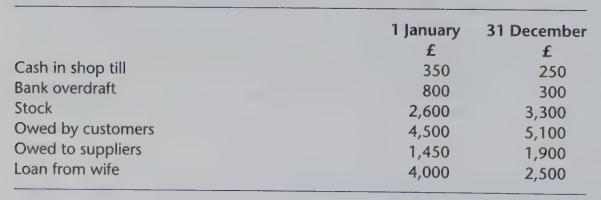

Jackson owns a retail shop. From the few records he keeps the following information is avail- able for the beginning and end of 20X0:

(a) Jackson tells you that during 20X0 he took from the till, before making the weekly bankings:

(i) £200 a week for his personal expenses, and (ii) £80 a week for his assistant’s wages.

(b) Returned cheques show that all payments out of the bank account were to suppliers except:

(i) a payment of £250 to an insurance company, being £150 for the insurance of the shop's contents and £100 for the insurance of Jackson’s own house, and (ii) a payment of £600 for furniture for Jackson’s own house.

(c) During the year Jackson had paid business expenses of £3,100 through his private bank account.

(d) Although no record of it is kept, Jackson owned the shop purchased on 1 January 19X6 for £40,000 and shop fittings and fixtures purchased on the same date for £6,000. It is agreed that fair rates of depreciation are 5 per cent per annum on cost for the shop and 10 per cent per annum on cost for the fittings and fixtures.

Required:

(a) Calculate Jackson’s profit for 20X0.

(b) Compile a statement of the financial position of this business on 31 December 20X0.

Step by Step Answer:

Accounting Theory And Practice

ISBN: 9780273651611

7th Edition

Authors: M. W. E. Glautier, Brian Underdown