A businessman has no double-entry records of his transactions but has a cash book from which the

Question:

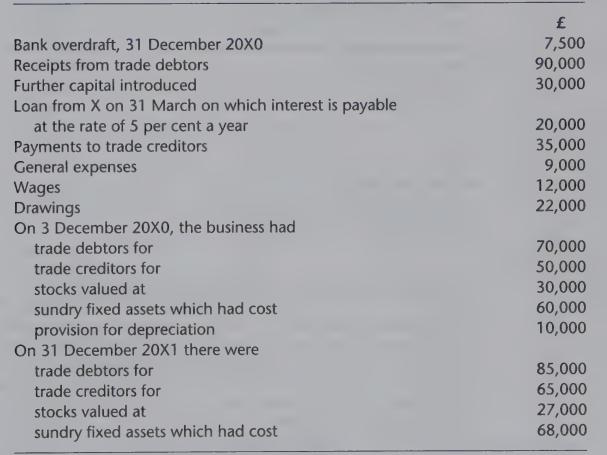

A businessman has no double-entry records of his transactions but has a cash book from which the following summary for the year ended 31 December 20X1 has been prepared:

Draft a profit and loss account for the year ended 31 December 20X1, and a balance sheet as at that date, providing for 5 per cent depreciation of the fixed assets on a straight-line basis.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Accounting Theory And Practice

ISBN: 9780273651611

7th Edition

Authors: M. W. E. Glautier, Brian Underdown

Question Posted: