Question: Analyse the following cash flow statement and comment on the liquidity position and financial planning of the company. Cash Flow Statement Particulars (A) Cash Flow

Analyse the following cash flow statement and comment on the liquidity position and financial planning of the company.

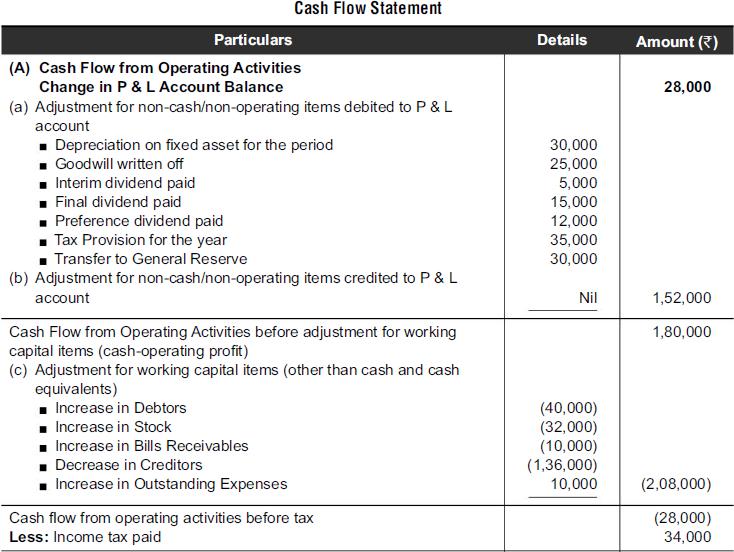

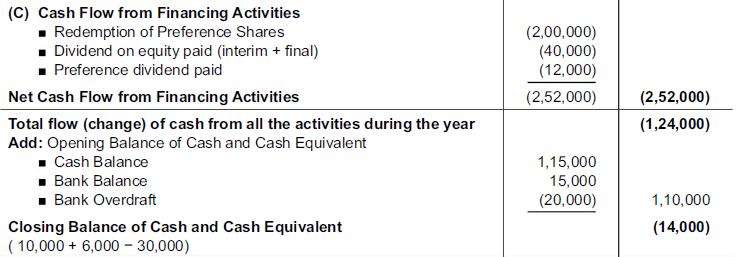

Cash Flow Statement Particulars (A) Cash Flow from Operating Activities Change in P & L Account Balance (a) Adjustment for non-cash/non-operating items debited to P & L account Depreciation on fixed asset for the period Goodwill written off Interim dividend paid Final dividend paid Preference dividend paid Tax Provision for the year Transfer to General Reserve (b) Adjustment for non-cash/non-operating items credited to P & L account Cash Flow from Operating Activities before adjustment for working capital items (cash-operating profit) (c) Adjustment for working capital items (other than cash and cash equivalents) Increase in Debtors Increase in Stock Increase in Bills Receivables Decrease in Creditors Increase in Outstanding Expenses Cash flow from operating activities before tax Less: Income tax paid Details 30,000 25,000 5,000 15,000 12,000 35,000 30,000 Nil (40,000) (32,000) (10,000) (1,36,000) 10,000 Amount () 28,000 1,52,000 1,80,000 (2,08,000) (28,000) 34,000

Step by Step Solution

3.42 Rating (149 Votes )

There are 3 Steps involved in it

A careful analysis of the given cash flow statement reveals the following dimensions of managerial s... View full answer

Get step-by-step solutions from verified subject matter experts