Assume Dessert Corner, Inc., completed the following transactions during 2018, the companys 10th year of operations: Requirements

Question:

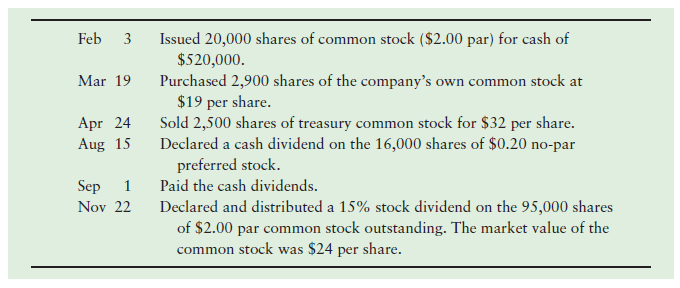

Assume Dessert Corner, Inc., completed the following transactions during 2018, the company’s 10th year of operations:

Requirements

1. Analyze each transaction in terms of its effect on the accounting equation of Dessert Corner.

2. What impact did each transaction have on cash flows?

Transcribed Image Text:

Feb Issued 20,000 shares of common stock ($2.00 par) for cash of $520,000. Purchased 2,900 shares of the company's own common stock at $19 per share. Sold 2,500 shares of treasury common stock for $32 per share. Declared a cash dividend on the 16,000 shares of $0.20 no-par preferred stock. Mar 19 Apr 24 Aug 15 Paid the cash dividends. Sep Declared and distributed a 15% stock dividend on the 95,000 shares of $2.00 par common stock outstanding. The market value of the Nov 22 common stock was $24 per share.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 100% (18 reviews)

Req 1 and 2 ASSETS LIABILITIES STOCKHOLDERS ...View the full answer

Answered By

Nazrin Ziad

I am a post graduate in Zoology with specialization in Entomology.I also have a Bachelor degree in Education.I posess more than 10 years of teaching as well as tutoring experience.I have done a project on histopathological analysis on alcohol treated liver of Albino Mice.

I can deal with every field under Biology from basic to advanced level.I can also guide you for your project works related to biological subjects other than tutoring.You can also seek my help for cracking competitive exams with biology as one of the subjects.

3.30+

2+ Reviews

10+ Question Solved

Related Book For

Financial Accounting

ISBN: 978-0134725987

12th edition

Authors: C. William Thomas, Wendy M. Tietz, Walter T. Harrison Jr.

Question Posted:

Students also viewed these Business questions

-

The following accounts and related balances of Eagle Designers, Inc., as of December 31, 2018, are arranged in no particular order: Requirements 1. Prepare Eagles classified balance sheet in the...

-

Assume Dotty Cakes, Inc., completed the following transactions during 2018, the companys 10th year of operations: Requirements 1. Analyze each transaction in terms of its effect on the accounting...

-

The Cheesecake Factory Incorporated (NASDAQ: CAKE) is publicly held and had more than 93 million common shares outstanding as of the end of the 2016 fiscal year. The company has preferred stock...

-

Greety Food in Ashland, Kentucky, manufactures and markets snack foods. Sita Lee manages the company's fleet of 220 delivery trucks. Lee has been charged with *reengineering* the fleet-management...

-

Let C and D be m n matrices, and let B = (v1, v2, ..., vn) be a basis for a vector V. Show that if C[x]B = D[x]B for all x in V, then C = D.

-

Find u (v x w). u = 2, 0, 0 v = 1, 1, 1 w = 0, 2, 2

-

Definir las redes sociales y describir cmo se diferencian de los medios de publicidad tradicionales . OA2

-

This information relates to Rana Co. 1. On April 5, purchased merchandise from Craig Company for $25,000, terms 2/10, net/30, FOB shipping point. 2. On April 6, paid freight costs of $900 on...

-

1. Suppose the expected return on the S&P 500 Index is 9.10% and the yield on U.S. Treasury securities is 1.52%. What is the market risk premium? A. 5.99% B. 7.58% C. 13.83% D. 10.62% 2. Suppose the...

-

Zane Perelli currently has $100 that he can spend today on polo shirts costing $25 each. Alternatively, he could invest the $100 in a risk-free U.S. Treasury security that is expected to earn a 9%...

-

Jubilee Jewelry Company reported the following summarized balance sheet at December 31, 2018: During 2019, Jubilee Jewelry completed these transactions that affected stockholders equity: Requirements...

-

Sullivan Medical Goods is embarking on a massive expansion. Assume plans call for opening 20 new stores during the next two years. Each store is scheduled to be 30% larger than the companys existing...

-

For Valentines Day, Ms. Sweet will mix some $6-per-lb nuts with some $3-per-lb chocolate candy to obtain 100 lb of mix, which she will sell at $3.90 per lb. How many pounds of each should she use?...

-

If f ( x ) = ( 1 3 - In ( x ) ) ^ 8 , determine f ' ( 1 ) .

-

1. ThestocksAandBhavethefollowingdistributionsofreturns. A B Probability State1 3 4 0.2 State2 5 2 0.3 State3 4 8 0.2 State4 6 5 0.1 State5 6 1 0.2 2....

-

Define nested designs. Explain why the nested designs are important.

-

3 x y 3 + x y = l n ( x ) solve for d y d x

-

Let ln ( xy ) + y ^ 8 = x ^ 7 + 2 . Find dy / dx .

-

Construct a coulometric titration curve of 100.0 mL of a 1 M H 2 SO 4 solution containing Fe(II) titrated with Ce(IV) generated from 0.075 M Ce(III). The titration is monitored by potentiometry. The...

-

Calculate I, , and a for a 0.0175 m solution of Na 3 PO 4 at 298 K. Assume complete dissociation. How confident are you that your calculated results will agree with experimental results?

-

Kroger, Safeway Inc., and Winn-Dixie Stores Inc. are three grocery chains in the United States. Inventory management is an important aspect of the grocery retail business. Recent balance sheets for...

-

On the basis of the following data, estimate the cost of the merchandise inventory at November 30 by the retailmethod: Retail Cost November 1 November 1-30 November 1-30 Merchandise inwentory...

-

Based on the following data, estimate the cost of ending merchandise inventory: Sales (net) $ 5,260,000 Estimated gross profit rate 40% Beginning merchandise inventory $ 180,000 Purchases (net)...

-

Question 7 of 7 0/14 W PIERDERY Current Attempt in Progress Your answer is incorrect Buffalo Corporation adopted the dollar value LIFO retail inventory method on January 1, 2019. At that time the...

-

Cost of debt with fees . Kenny Enterprises will issue a bond with a par value of $1,000, a maturity of twenty years, and a coupon rate of 9.9% with semiannual payments, and will use an investment...

-

Assume that an investment of $100,000 is expected to grow during the next year by 8% with SD 20%, and that the return is normally distributed. Whats the 5% VaR for the investment? A. $24,898 B....

Study smarter with the SolutionInn App