Assume Purity Ice Cream Company, Inc., in Ithaca, NY, bought a new ice cream production kit (pasteurizer/homogenizer,

Question:

Assume Purity Ice Cream Company, Inc., in Ithaca, NY, bought a new ice cream production kit (pasteurizer/homogenizer, cooler, aging vat, freezer, and filling machine) at the beginning of the year at a cost of $152,000. The estimated useful life was four years, and the residual value was $8,000. Assume that the estimated productive life of the machine was 16,000 hours. Actual annual usage was 5,500 hours in Year 1; 3,800 hours in Year 2; 3,200 hours in Year 3; and 3,500 hours in Year 4.

Required:

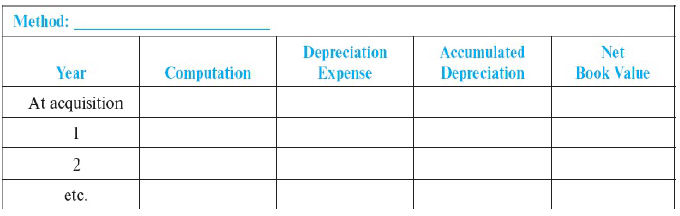

1. Complete a separate depreciation schedule for each of the alternative methods. Round your answers to the nearest dollar.

a. Straight-line.

b. Units-of-production (use two decimal places for the per unit output factor).

c. Double-declining-balance.

2. Assuming that the machine was used directly in the production of one of the ice cream products that the company manufactures and sells, what factors might management consider in selecting a preferable depreciation method in conformity with the expense recognition principle?

Step by Step Answer:

Financial Accounting

ISBN: 978-1259964947

10th edition

Authors: Robert Libby, Patricia Libby, Frank Hodge