Examine the financial data of Musketeer Corporation. Calculate Musketeers current ratio for each year from 2016 through

Question:

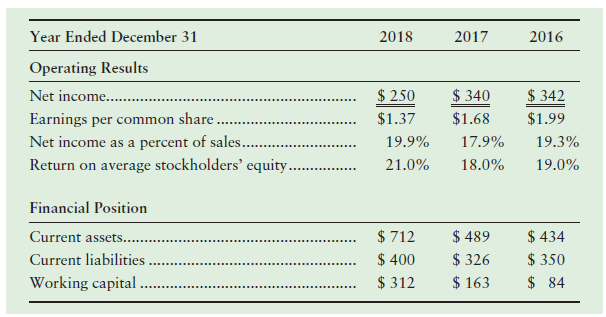

Examine the financial data of Musketeer Corporation.

Calculate Musketeer’s current ratio for each year from 2016 through 2018. Is the company’s ability to pay its current liabilities improving or deteriorating?

Year Ended December 31 2018 2017 2016 Operating Results $ 250 $ 340 $ 342 Net income.. Earnings per common share . Net income as a percent of sales... $1.37 $1.68 $1.99 19.9% 17.9% 19.3% Return on average stockholders' equity... 21.0% 18.0% 19.0% Financial Position $ 489 $ 326 $ 163 $ 434 $ 350 $ 84 $ 712 $ 400 $ 312 Current assets.. Current liabilities. Working capital .

Step by Step Answer:

The companys ability to pay its curr...View the full answer

Financial Accounting

ISBN: 978-0134725987

12th edition

Authors: C. William Thomas, Wendy M. Tietz, Walter T. Harrison Jr.

Related Video

The current ratio is a financial ratio that measures a company\'s ability to pay its short-term obligations with its short-term assets. It is calculated by dividing a company\'s current assets by its current liabilities. The formula for calculating the current ratio is: Current Ratio = Current Assets / Current Liabilities Current assets are assets that can be converted to cash within one year, while current liabilities are debts that are due within one year. A current ratio of 1:1 or greater is generally considered good, as it indicates that a company has enough current assets to cover its current liabilities. A current ratio of less than 1:1 may suggest that a company may have difficulty meeting its short-term obligations. It\'s important to note that the current ratio is just one of many financial ratios that can be used to assess a company\'s financial health. It should be used in conjunction with other financial ratios and qualitative factors to make informed decisions about investing or lending to a company.

Students also viewed these Business questions

-

Calculate the current ratio for each year. Canna, Inc. Comparative Income Statement Years Ended December 31, 2019 and 2018 Amounts 2018 2019 1635750 9 6750 1539000 106 6 300 4 72700 2 15000 2 10000...

-

Examine the financial data of Jacob Corporation. Show how to compute Jacobss current ratio for each year 2008 through 2010. Is the companys ability to pay its current liabilities improving...

-

Examine the financial data of Stephens Corporation. Show how to compute Stephens current ratio for each year 2010 through 2012. Is the companys ability to pay its current liabilities improving...

-

Monroe Inc. is an all-equity firm with 500,000 shares outstanding. It has $2,000,000 of EBIT, and EBIT is expected to remain constant in the future. The company pays out all of its earnings, so...

-

The subspace of R3 spanned by the vectors and u2 = (0, 1, 0) is a plane passing through the origin. Express w = (1, 2, 3) in the form w = w1 + w2, where w1 lies in the plane and w2 is perpendicular...

-

Find an equation in rectangular coordinates for the surface represented by the cylindrical equation, and sketch its graph. z = r 2 sin 2 + 3r cos

-

4 Suponga que la empresa de podadoras de csped Great States tiene la situacin de concentracin mercado-producto que se muestra en la figura 22-4A. Cules son las sinergias y posibles problemas de...

-

Robert Triffin bought a number of dishonored checks from McCalls Liquor Corp., Community Check Cashing II, LLC (CCC), and other licensed check cashing businesses in New Jersey. Seventeen of the...

-

A company reports sales of $6,000,000, gross profit of $2,000,000, beginning inventory of $200,000, and ending inventory of $300,000. What is the inventory turnover for the period?

-

Barrett Chemicals manufactures four chemicals, Chem-1, Chem-2, Chem-3, and Chem-4, from a joint process. The total joint costs in May were $564,000. Additional information follows: Required Barrett...

-

Madison Company and Orwell Corporation are competitors. Compare the two companies by converting their condensed income statements to common-size statements. Which company earned more net income?...

-

To follow are the balance sheets for Metro Corporation and selected comparative competitor data. Use the data to answer the following questions. 1. Calculate Metros quick (acid-test) ratio at...

-

Crop damage by wild boars. Refer to the Current Zoology (Apr. 2014) study of crop damage incurred by wild boars in southern Italy, Exercise 3.18 (p. 158). If crop damage by wild boars occurs, the...

-

You will be creating a Performance Improvement Plan to address an employee in the attached case study (see below). This is a scenario you may encounter in your future HR profession, so this...

-

For this prompt, consider your academic goals, including (but not limited to) such topics as how you plan to manage your time to fit in your studies; how you will build your skills, as needed; how...

-

1. An introduction of you as a leader (whether or not you see yourself as a leader, whether or not you like being a leader, what kinds of leadership roles you have had, etc.). 2. Summarize your...

-

Briefly, describe the firm in terms of the following items. a. Size in terms of market capitalization, annual revenue, number of employees, location(s). b. Discuss the financial position of the firm....

-

HealthyLife (HL) is a publicly-traded company in the Food Manufacturing Industry. HealthyLife has been around since the 1970s, and is mainly focused on the production and wholesale of "organic and...

-

Identify the principal conjugate acid-base pair and calculate the ratio between them in a solution that is buffered to pH 6.00 and contains (a) H 2 SO 3 . (b) Citric acid. (c) Malonic acid. (d)...

-

Which internal control principle is especially diffi cult for small organizations to implement? Why?

-

A company issues a $2,000,000, 9%, five-year bond that pays semiannual interest of $90,000 ($2,000,000 9% ), receiving cash of $2,166,332. journalize the bond issuance.

-

A company issues a $6,000,000, 12%, five-year bond that pays semiannual interest of $360,000 ($6,000,000 12% ), receiving cash of $6,463,304. Journalize the bond issuance.

-

An $800,000 bond issue on which there is an unamortized discount of $60,000 is redeemed for $760,000. Journalize the redemption of the bonds.

-

The predetermined overhead rate is usually calculated Group of answer choices At the end of each year At the beginning of each month At the beginning of the year At the end of the month

-

ajax county collects property taxes for the cities within the county, Ajax county collected 1000 from citizens in Beatty city that belong to Beatty city what would be the appropriate entries for ajax...

-

Assume that gasoline costs $ 3 . 2 0 per gallon and you plan to keep either car for six years. How many miles per year would you need to drive to make the decision to buy the hybrid worthwhile,...

Study smarter with the SolutionInn App