Financial Technologies Limited was promoted in 1988 by a first generation entrepreneur named Jignesh Shah. The firm

Question:

Financial Technologies Limited was promoted in 1988 by a first generation entrepreneur named Jignesh Shah. The firm and its arms (commonly known as FT group) went on to become a global leader in offering technology and domain expertise to create and trade on next-generation financial markets, across all asset classes including equities, commodities and currencies among others. FT had a market value of over ₹15,000 crore in FY2012.

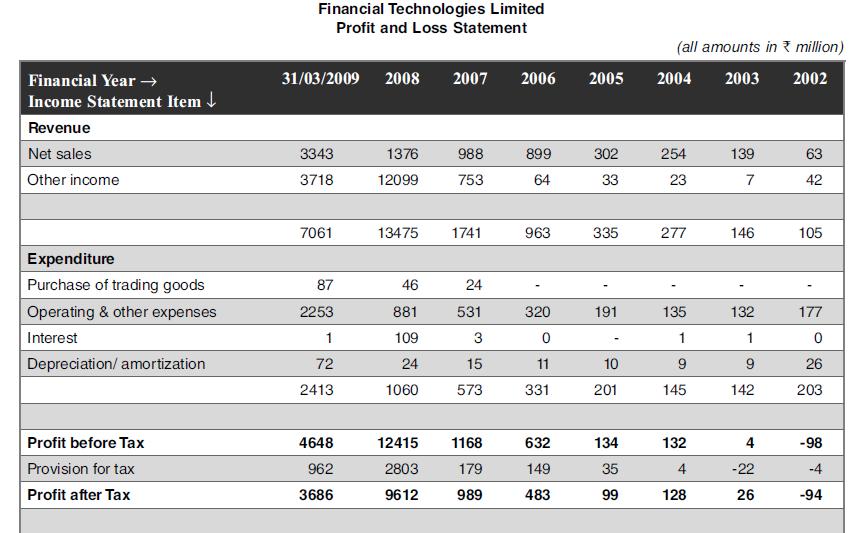

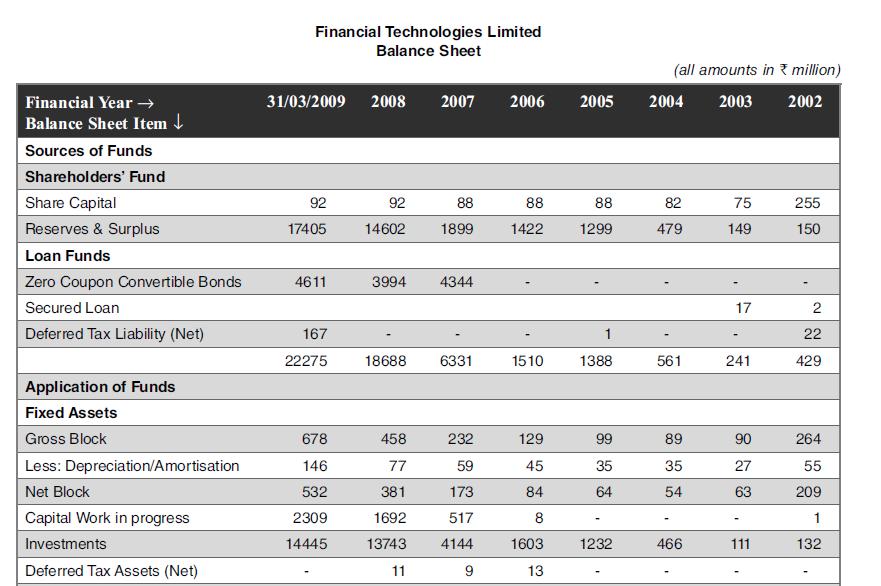

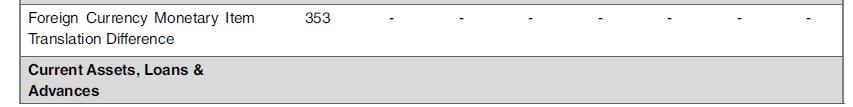

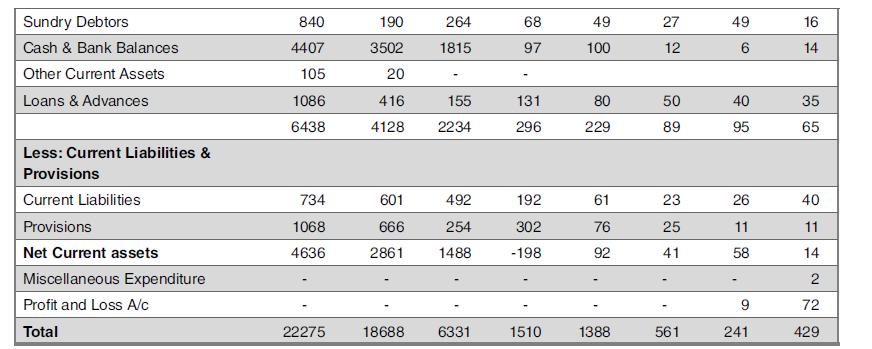

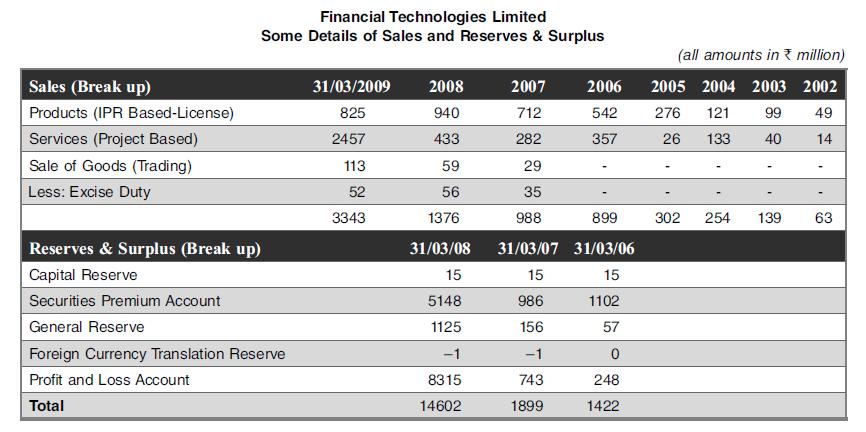

Given below are the two standalone financial statements, i.e., profit and loss account and balance sheet of Financial Technologies (India) Ltd, for the period FY2002-09. Please go through them and answer the questions.

1. What are the major changes in the financial statements between FY2002 and FY2009? (say, the major portions of assets in FY2002 and after) Discuss.

2. Do the financial statements clearly cover the main business of the company? Discuss

3. Can FT use its Reserves & Surpluses to distribute dividends to the shareholders? If yes, to what extent?

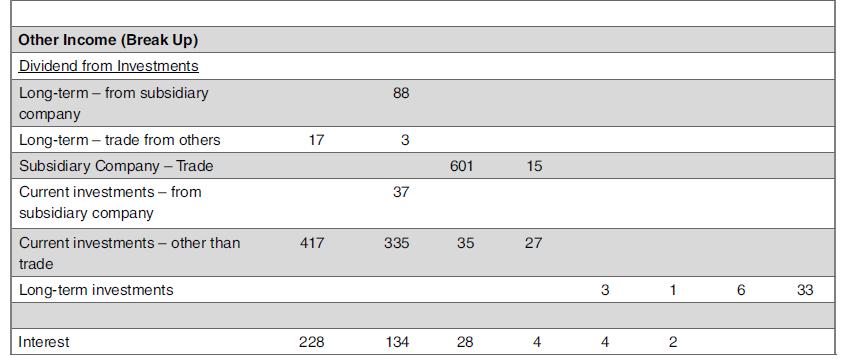

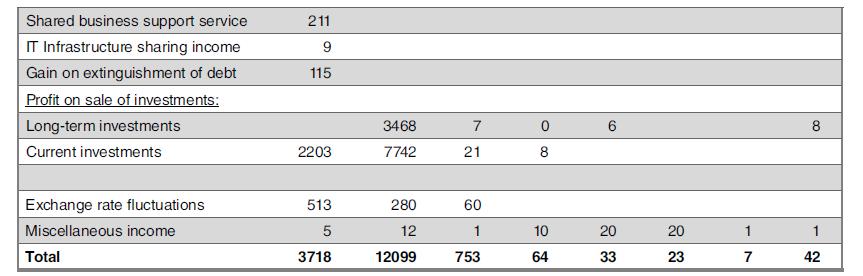

4. Comment on the item “other income” and its changes during the period?

5. In 2013, India’s commodity markets regulator, the Forward Markets Commission (FMC), declared that FT was “not fit and proper” to run few of its arms such as regulated exchange like MCX, after one of its arms, the National Spot Exchange Limited (NSEL) defaulted in trade settlements in August 2013. In fact, this scam is one of the largest in India’s financial market history with over 13,000 investors being duped of a whopping ₹5,690 crore.3 The move resulted in FT’s market value falling to less than ₹1,000 crore. What could be the reason for such a fall? What items in the FT’s income statement get negatively influenced by such regulatory restrictions? Give reasons for your response.

6. How can the ‘accounting regulators’ including ICAI take steps to ensure that investors of FT do not get hurt?

Step by Step Answer:

Financial Accounting For Management

ISBN: 9789385965661

4th Edition

Authors: Neelakantan Ramachandran, Ram Kumar Kakani