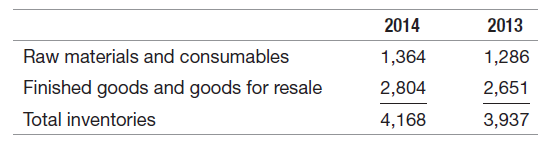

In its 2014 annual report the Unilever Group, which published IFRS-based financial statements, reported the following in

Question:

€œDuring 2014, 126 million euros (2013: 198 million euros) was charged to the income statement for damaged, obsolete, and lost inventories. In 2014, 120 million euros (2013: 155 million euros) was utilized or released to the income statement for inventory provisions taken in earlier years.€

a. Is Unilever a manufacturer or a retailer, and how do you know?

b. Does Unilever use the FIFO or LIFO inventory assumption, and how do you know?

c. What is an inventory write-down and an inventory recovery? Record the entries made by Unilever at the end of 2014 for the write-down and recovery.

d. How would Unilever€™s accounting have been different if it used U.S. GAAP instead of IFRS?

Generally Accepted Accounting Principles (GAAP) is the accounting standard adopted by the U.S. Securities and Exchange Commission (SEC). While the SEC previously stated that it intends to move from U.S. GAAP to the International Financial Reporting Standards (IFRS), the...

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Question Posted: