P, Q and R are in partnership sharing profits and losses in the ratio of 2 :

Question:

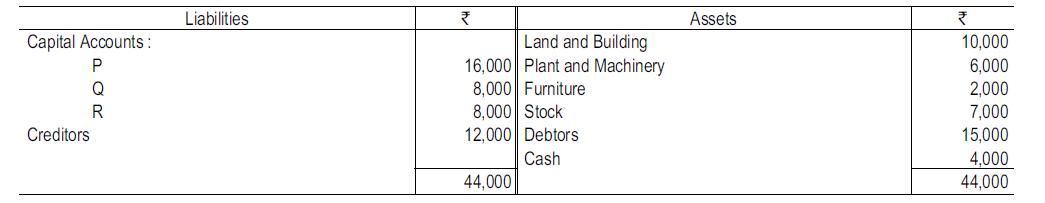

P, Q and R are in partnership sharing profits and losses in the ratio of 2 : 2 : 1. P retired on 31.12.2017 and on that date, the Balance Sheet of the firm was as under :

On P’s retirement, Goodwill is valued at ₹10,000 and the assets are revalued as follows : Land and Building ₹12,000; Plant and machinery ₹5,000;

Furniture ₹1,500; Debtors ₹12,500. While apportioning profits for the year 2017, an amount of ₹3,000 was given to P in excess, Q and R provide cash in their profit sharing ratio in order to pay-off P. You are required to pass Journal Entries, prepare Revaluation Account, Partners’ Capital Accounts and the Balance Sheet after P’s retirement.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Financial Accounting Volume II

ISBN: 9789387886230

4th Edition

Authors: Mohamed Hanif, Amitabha Mukherjee

Question Posted: