Suppose you work in the loan department of Third National Bank. Byron Blakely, the owner of Byrons

Question:

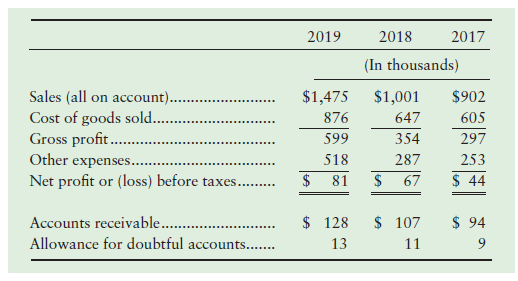

Suppose you work in the loan department of Third National Bank. Byron Blakely, the owner of Byron’s Beauty Solutions, has come to you seeking a loan for $500,000 to expand operations. He proposes to use accounts receivable as collateral for the loan and has provided you with the following information from the company’s most recent financial statements:

Requirement

1. Analyze the trends of sales, days’ sales outstanding, and cash collections from customers for 2019 and 2018. Would you make the loan to Blakely? Support your decision with facts and figures. Assume there are no write-offs in 2018 and 2019.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Financial Accounting

ISBN: 978-0134725987

12th edition

Authors: C. William Thomas, Wendy M. Tietz, Walter T. Harrison Jr.

Question Posted: