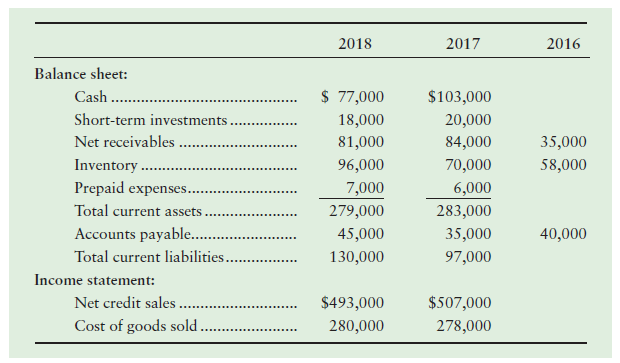

The financial statements of Explorer News, Inc., include the following items: Requirements 1. Calculate the following ratios

Question:

The financial statements of Explorer News, Inc., include the following items:

Requirements

1. Calculate the following ratios for 2018 and 2017. When calculating days, round your answer to the nearest whole number.

a. Current ratio

b. Quick (acid-test) ratio

c. Inventory turnover and days’ inventory outstanding (DIO)

d. Accounts receivable turnover

e. Days’ sales in average receivables or days’ sales outstanding (DSO)

f. Accounts payable turnover and days’ payable outstanding (DPO). Use cost of goods sold in the formula for accounts payable turnover.

g. Cash conversion cycle (in days)

2. Evaluate the company’s liquidity and current debt-paying ability for 2018. Has it improved or deteriorated from 2017?

3. As a manager of this company, what would you try to improve next year?

Cash Conversion CycleCash conversion cycle measures the total time a business takes to convert its cash on hand to produce, pay its suppliers, sell to its customers and collect cash from its customers. The process starts with purchasing of raw materials from suppliers,... Financial Statements

Financial statements are the standardized formats to present the financial information related to a business or an organization for its users. Financial statements contain the historical information as well as current period’s financial... Accounts Receivable

Accounts receivables are debts owed to your company, usually from sales on credit. Accounts receivable is business asset, the sum of the money owed to you by customers who haven’t paid.The standard procedure in business-to-business sales is that...

Step by Step Answer:

Financial Accounting

ISBN: 978-0134725987

12th edition

Authors: C. William Thomas, Wendy M. Tietz, Walter T. Harrison Jr.