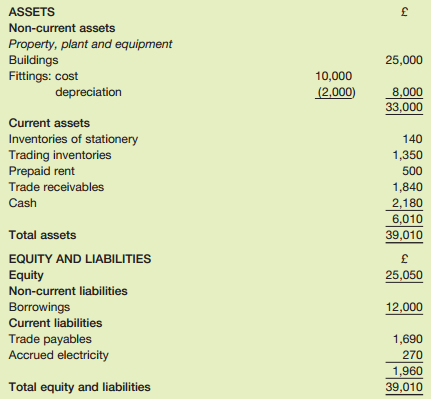

The following is the statement of financial position of Davids business at 1 January of last year.

Question:

The following is a summary of the transactions that took place during the year:

1 Inventories were bought on credit for £17,220.

2 Inventories were bought for £3,760 cash.

3 Credit sales revenue amounted to £33,100 (cost £15,220).

4 Cash sales revenue amounted to £10,360 (cost £4,900).

5 Wages of £3,770 were paid.

6 Rent of £3,000 was paid. The annual rental amounts to £3,000.

7 Electricity of £1,070 was paid.

8 General expenses of £580 were paid.

9 Additional fittings were purchased on 1 January for £2,000. The cash for this was raised from additional borrowings of this amount. The interest rate is 10 per cent a year, the same as for the existing borrowings.

10 £1,000 of the borrowing was repaid on 30 June.

11 Cash received from trade receivables amounted to £32,810.

12 Cash paid to trade payables amounted to £18,150.

13 The owner withdrew £10,400 cash and £560 inventories for private use.

At the end of the year it was found that:

— The electricity bill for the last quarter of the year for £290 had not been paid.

— Trade receivables amounting to £260 were unlikely to be received.

— The value of stationery remaining was estimated at £150. Stationery is included in general expenses.

— The borrowings carried interest of 10 per cent a year and was unpaid at the year end.

Depreciation is to be taken at 20 per cent on the cost of the fittings owned at the year end.

Buildings are not depreciated.

Required:

(a) Open ledger accounts and bring down all of the balances in the opening statement of financial position.

(b) Make entries to record the transactions 1 to 13 (above), opening any additional accounts as necessary.

(c) Open an income statement (part of the double entry, remember). Make the necessary entries for the bulleted list above and the appropriate transfers to the income statement.

(d) List the remaining balances in the same form as the opening statement of financial position (above).

Step by Step Answer:

Accounting An Introduction

ISBN: 9780273733201

5th Edition

Authors: Eddie McLaney, Dr Peter Atrill, Eddie J. Mclan