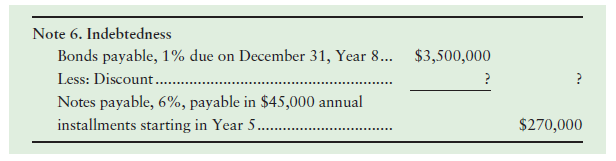

The notes to the Thorson Ltd. financial statements reported the following data on December 31, Year 1

Question:

The notes to the Thorson Ltd. financial statements reported the following data on December 31, Year 1 (end of the fiscal year):

Thorson amortizes bond discounts using the effective-interest method and pays all interest amounts at December 31.

Requirements

1. Assume the market interest rate is 6% on January 1 of year 1, the date the bonds are issued.

a. Using the PV function in Excel, what is the issue price of the bonds?

b. What is the maturity value of the bonds?

c. What is Thorson’s annual cash interest payment on the bonds?

d. What is the carrying amount of the bonds at December 31, year 1?

2. Prepare an amortization table through the maturity date for the bonds using Excel. (Round all amounts to the nearest dollar.) How much is Thorson’s interest expense on the bonds for the year ended December 31, Year 4?

3. Show how Thorson would report these bonds and notes at December 31, Year 4.

Financial StatementsFinancial statements are the standardized formats to present the financial information related to a business or an organization for its users. Financial statements contain the historical information as well as current period’s financial... Maturity

Maturity is the date on which the life of a transaction or financial instrument ends, after which it must either be renewed, or it will cease to exist. The term is commonly used for deposits, foreign exchange spot, and forward transactions, interest...

Step by Step Answer:

Financial Accounting

ISBN: 978-0134725987

12th edition

Authors: C. William Thomas, Wendy M. Tietz, Walter T. Harrison Jr.