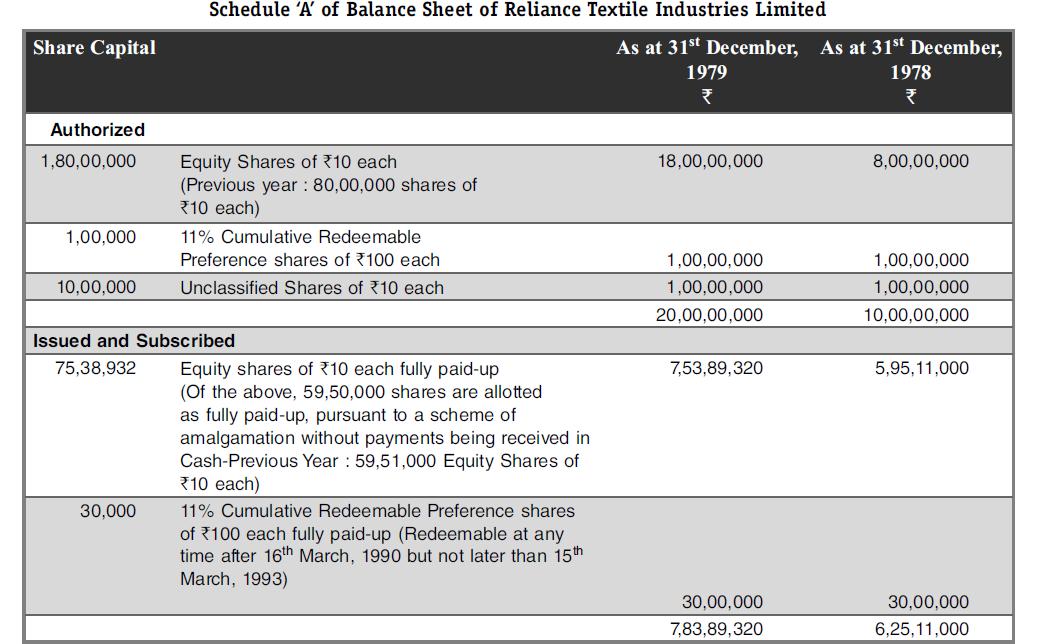

The Reliance group started growing initially, through an expansion of Reliance Textile Industries Limited. The following are

Question:

The Reliance group started growing initially, through an expansion of Reliance Textile Industries Limited.

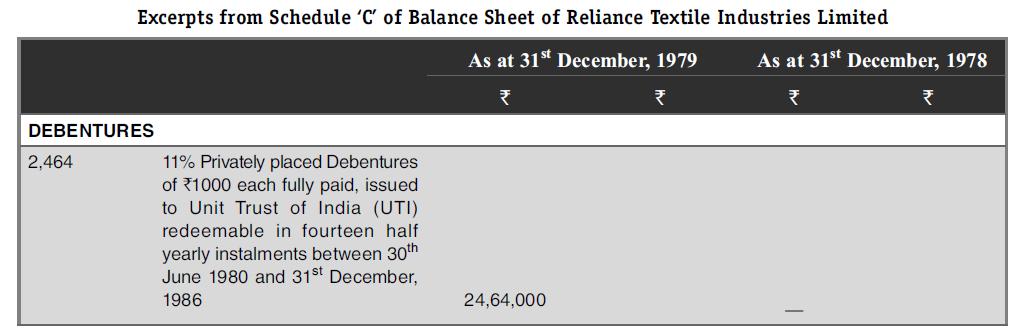

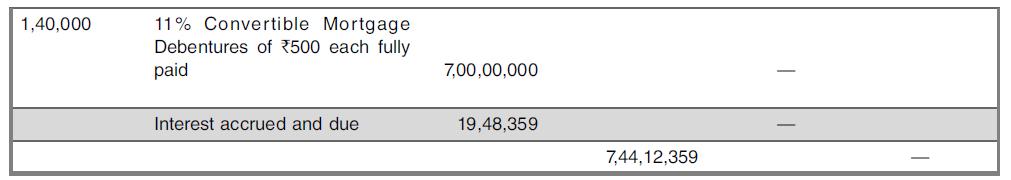

The following are the excerpts forming a part of the balance sheet of Reliance Textile Industries Limited, from its annual report for the financial year ending 1979.

Notes to Schedule ‘A’

1. The company had issued and allotted 9,40,000 equity shares of ₹10 each at par, to financial institutions on their exercising the option during the year to convert twenty percent of their loans into the company’s equity capital.

2. The Company had issued and allotted 6,47,832 right equity shares of ₹10 each, for cash, at a premium of ₹15 per share.

Notes to Schedule ‘C’

1. Term Loans from Banks are secured by hypothecation of specific items of plant and machinery by way of prior charge in their favor.

2. Privately placed Debentures and the Term Loan from LIC is secured by way of Legal Mortgage in English Form. Term Loans from the above referred financial institutions and deferred payment liabilities guaranteed by banks are secured by a Joint Equitable Mortgage of immovable properties, both present and future, by way of deposit of the Title Deeds and hypothecation of present and future moveable assets of the company. The aforesaid charges shall rank pari-passu without preference of one over the other, subject to a prior charge in favour of the Company’s bankers referred to in (1) above and ‘Bankers’ Goods’.

3. The holders of 1,40,000 11% Convertible Mortgage Debenture of ₹500 each have an option to convert 20% of the nominal value of each Debenture into four Equity shares of ₹10 each, credited as fully paid, at a premium of ₹15 per share, at any time during 1st October, to 30th November, 1980. In the event of the Company issuing bonus shares prior to Debenture holders exercising their option of conversion, the price of Equity Shares at which the conversion is to be effected shall get reduced in the same ratio of such Bonus Share Capital to the expanded Equity Share Capital. The balance face value of the Debentures after Conversion shall be redeemable in five equal annual installments between 25th October (1987) and 25th October (1991). Equitable Mortgage shall secure the said Debentures, by deposits of Title Deeds of the Company’s immovable properties, both present and future, and hypothecation of movable assets. The charge so created shall rank pari-passu with the Legal Mortgage in English Form and Equitable Mortgage referred to in (2) above, subject to the prior charge in favor of the Company’s Bankers referred to in (1) above and on ‘Bankers’ Goods’ (Relevant documents are to be executed between the Company and the Trustees).

4. Bridge Loans are secured by hypothecation of moveable assets, but subject to prior charge in respect of ‘Bankers’ goods’ for working capital purpose, and further secured by personal guarantees of some of the Directors.

5. The figures of the privately placed Debentures issued to UTI and Rupee Term Loans from Financial Institutions as at the end of the year, are arrived at after their exercising the option of conversion amounting to ₹94 lakh.

Case Questions

(a) What are the long notes to the schedule is (below each schedule) trying to convey? Is there anything good or bad about presenting such long notes to schedules?

(b) Was there any issue of shares or debentures during the financial year 1979 by Reliance Textiles? If so, please prepare entries assuming 100% subscription.

(c) Are the above products novel compared to the existing ways of raising money by a large number of publicly listed firms? Can we conclude that the Reliance Group has been innovative in many ways while raising finance from the capital markets?

Step by Step Answer:

Financial Accounting For Management

ISBN: 9789385965661

4th Edition

Authors: Neelakantan Ramachandran, Ram Kumar Kakani