This case will help you learn to use a companys inventory notes. The notes are part of

Question:

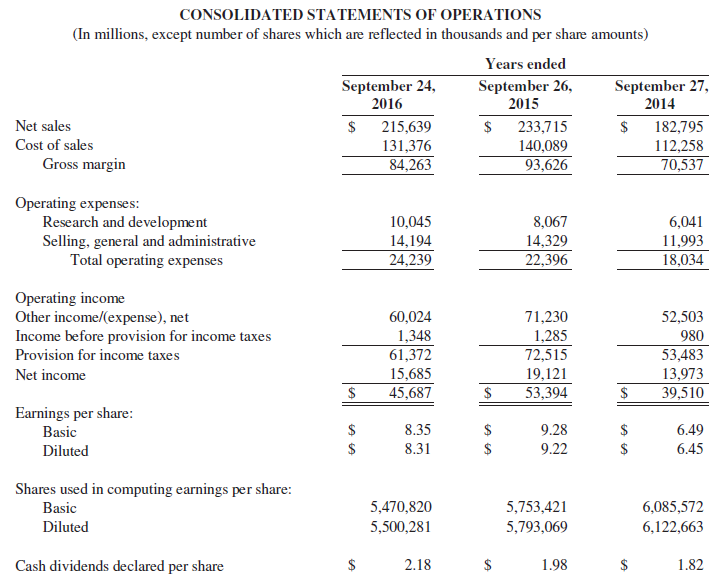

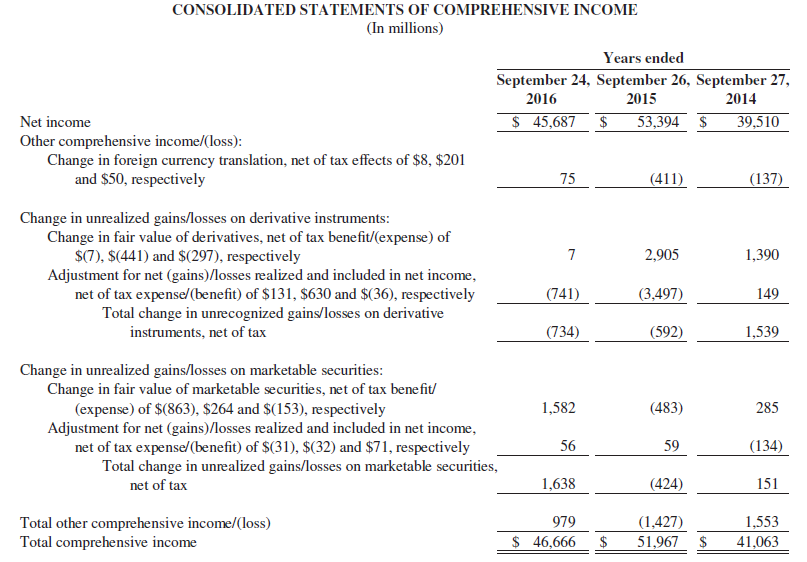

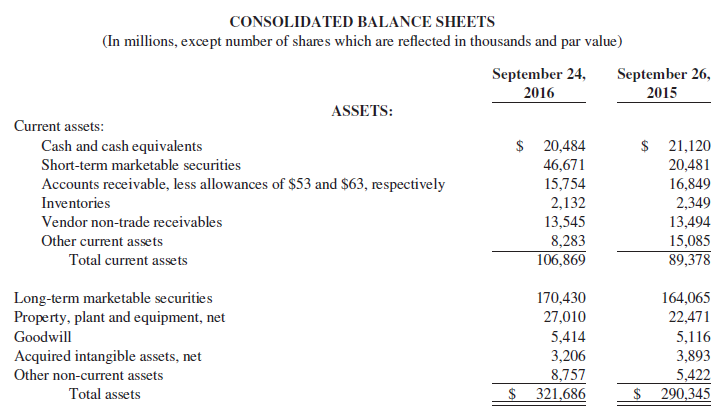

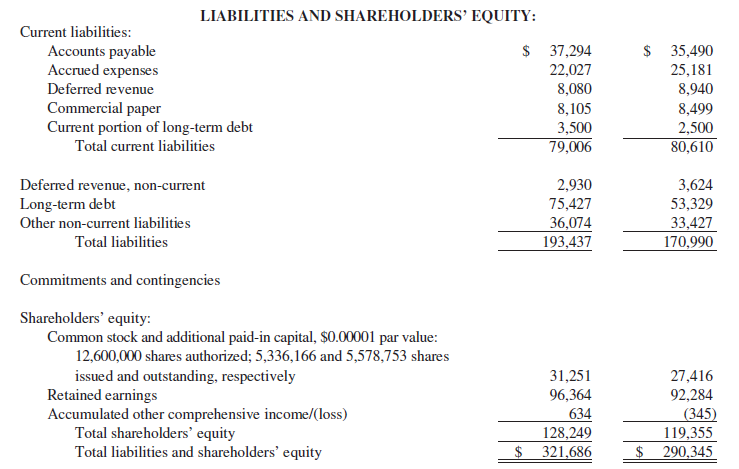

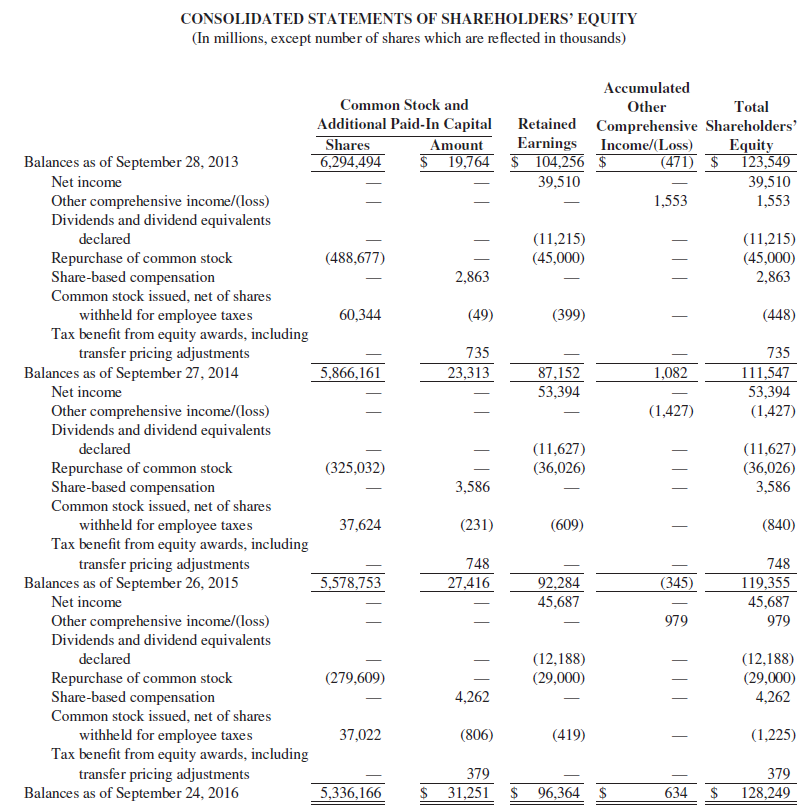

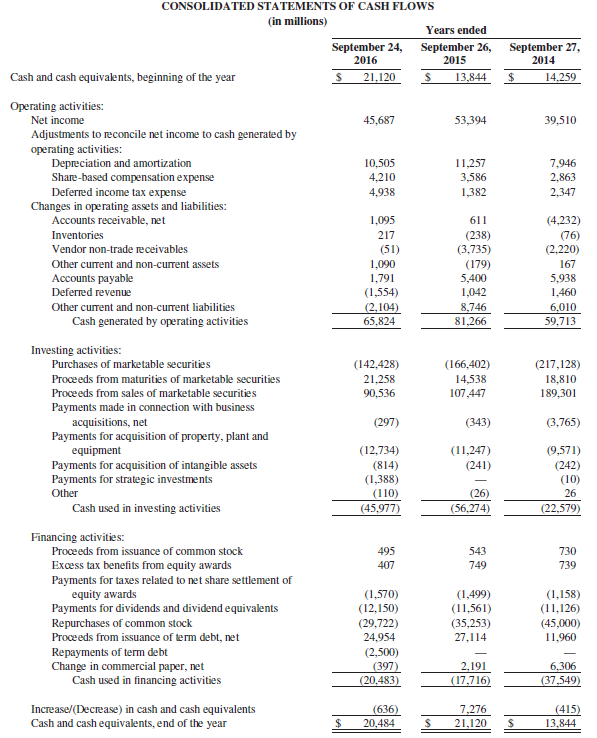

This case will help you learn to use a company’s inventory notes. The notes are part of the financial statements. They give details that would clutter the financial statements themselves. Refer to Apple Inc.’s consolidated financial statements and related notes in Appendix A and online in the filings section of www.sec.gov and answer the following questions:

Requirements

1. How much was Apple’s merchandise inventory at September 24, 2016? At September 26, 2015? Does Apple include all inventory that it handles in the inventory account on its balance sheet?

2. Refer to Note 1, Summary of Significant Accounting Policies, Inventories section. How does Apple value its inventories? Which cost method does the company use?

3. Using the cost-of-goods-sold model, compute Apple’s purchases of inventory during the year ended September 24, 2016.

4. Did Apple’s gross profit percentage on company sales improve or deteriorate in the year ended September 24, 2016, compared to the previous year?

5. Assume that ending inventory on September 27, 2014, was $2,111 million. (Remember that the ending inventory in one period becomes the beginning inventory in the next period.) Compute Apple’s inventory turnover for 2016 and 2015. Is Apple’s rate of inventory turnover for the years ended September 24, 2016, and September 26, 2015, fast or slow compared to most other companies in its industry? Explain your answer.

6. Go to the SEC’s website (www.sec.gov). Find Apple’s consolidated balance sheet and consolidated statement of operations for the fiscal year ended September 30, 2017. What has happened to the company’s inventory turnover and gross profit percentages since September 24, 2016? Why have they changed? Where would you find the company’s explanations for the changes? (Challenge)

Data from Apple Inc.'s

The ending inventory is the amount of inventory that a business is required to present on its balance sheet. It can be calculated using the ending inventory formula Ending Inventory Formula =... Financial Statements

Financial statements are the standardized formats to present the financial information related to a business or an organization for its users. Financial statements contain the historical information as well as current period’s financial... Balance Sheet

Balance sheet is a statement of the financial position of a business that list all the assets, liabilities, and owner’s equity and shareholder’s equity at a particular point of time. A balance sheet is also called as a “statement of financial...

Step by Step Answer:

Financial Accounting

ISBN: 978-0134725987

12th edition

Authors: C. William Thomas, Wendy M. Tietz, Walter T. Harrison Jr.