This problem continues with the business of Fitness Equipment Doctor, Inc., begun in the Continuing Problem in

Question:

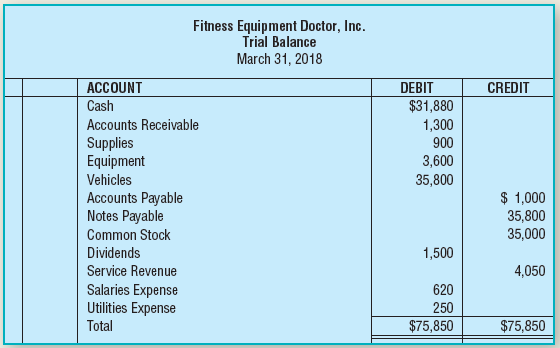

This problem continues with the business of Fitness Equipment Doctor, Inc., begun in the Continuing Problem in Chapter 1. Here you will account for Fitness Equipment Doctor, Inc.?s transactions using formal accounting practices. The trial balance for Fitness Equipment Doctor, Inc., as of March 31, 2018, is presented below.

The following transactions occurred during April:

April 1 Paid receptionist?s salary, $675.2 Paid cash to acquire land for a future office site, $16,000.3 Moved into a new location for the business and paid the first month?s rent, $1,500.4 Performed service for a customer and received cash, $1,700.5 Received $600 on account.8 Purchased $450 of supplies on account.11 Billed customers for services performed, $4,200.13 Sold an additional $10,000 of common stock to Adam Mazella.16 Paid receptionist?s salary, $675.17 Received $1,450 cash for services performed.18 Received $300 from customers on account.19 Paid $500 for advertising.21 Paid $700 on account.22 Purchased office furniture on account, $2,100.24 Paid miscellaneous expenses, $75.26 Billed customers for services provided, $1,900.28 Received $900 from customers on account.30 Paid utility bill, $245.30 Paid receptionist?s salary, $675.30 Paid $2,300 of dividends.

Requirements

1. Journalize the transactions that occurred in April. No explanations are necessary.

2. Open the ledger accounts listed in the trial balance and list their beginning balances at March 31. Use the four-column account format illustrated in the chapter. Enter ?Bal? for the March 31 balance in the Item column. Post the journal entries to the ledger, creating new ledger accounts as necessary; omit posting references. Calculate the new account balances at April 30, 2018.

3. Prepare the trial balance for Fitness Equipment Doctor, Inc., at April 30, 2018.

Step by Step Answer: