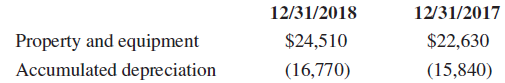

Walker Corporation reported the following related to property and equipment (all in millions): From the balance sheets:

Question:

Walker Corporation reported the following related to property and equipment (all in millions):

From the balance sheets:

From the investing activities section of the 2018 cash flow statement:

Cash used to purchase property and equipment ............. ($2,360)

Proceeds from sale of property and equipment ...................... 48

From the 2018 income statement:

Depreciation expense ..................................... $1,250

Gain or loss on the sale of equipment .................. ??

Requirements

1. Draw T-accounts for Property and Equipment and Accumulated Depreciation. Enter the information as presented and solve for the unknown in each account. (Hint: Recall the types of transactions that make each of the two accounts increase and decrease. You are solving for the cost of Property and Equipment sold and the Accumulated Depreciation on those assets.)

2. Based on your calculations in requirement 1, calculate the book value of assets sold during 2018. What is the difference between the sales price and the book value?

3. Prepare the journal entry for the sale of property and equipment during 2018. Describe the effect of this transaction on the financial statements. Compare the sales price and the book value in the journal entry, and compare this to the difference you calculated in requirement 2. Describe briefly.

4. Prepare a T-account for Property and Equipment, Net. Repeat requirement 1.

CorporationA Corporation is a legal form of business that is separate from its owner. In other words, a corporation is a business or organization formed by a group of people, and its right and liabilities separate from those of the individuals involved. It may...

Step by Step Answer:

Financial Accounting

ISBN: 978-0134725987

12th edition

Authors: C. William Thomas, Wendy M. Tietz, Walter T. Harrison Jr.