What is the largest single item included in Orlando Medicals debt ratio at December 31, 2018? a.

Question:

What is the largest single item included in Orlando Medical’s debt ratio at December 31, 2018?

a. Accounts payable

b. Cash and cash equivalents

c. Common stock

d. Investments

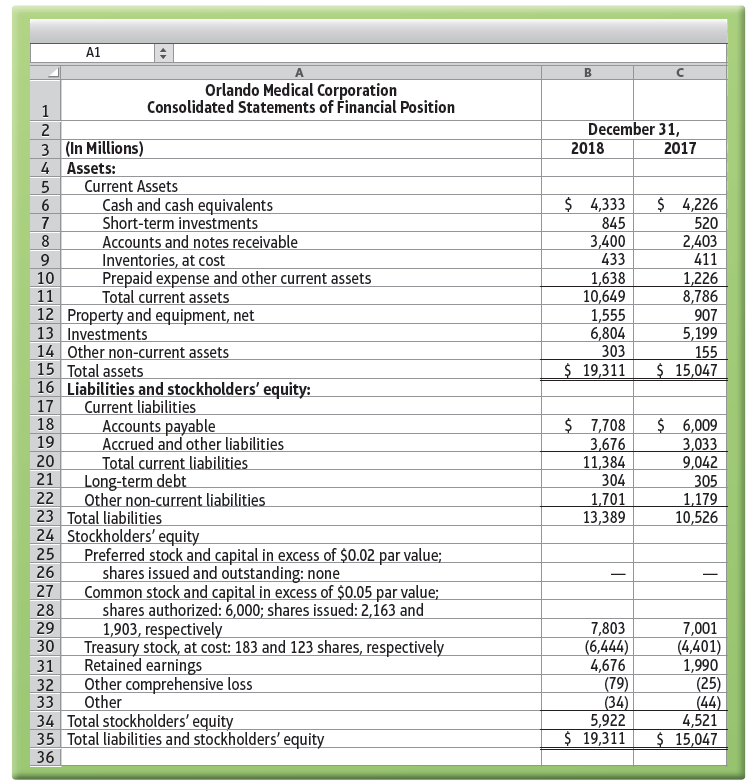

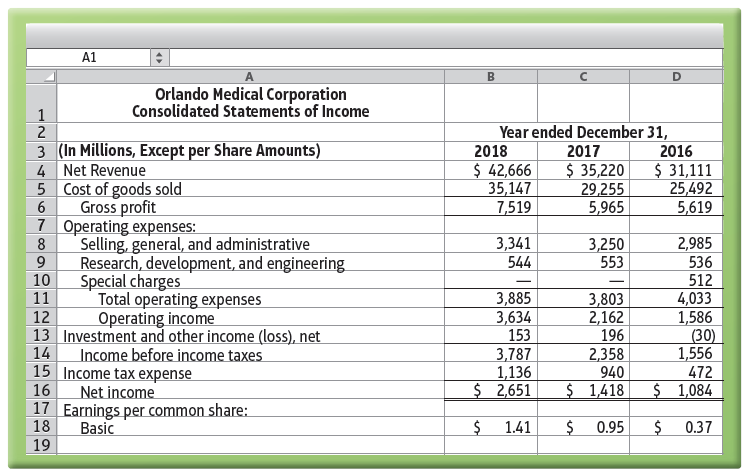

Use the Orlando Medical Corporation financial statements that follow to answer this question.

Financial statements are the standardized formats to present the financial information related to a business or an organization for its users. Financial statements contain the historical information as well as current period’s financial...

Transcribed Image Text:

A1 Orlando Medical Corporation Consolidated Statements of Financial Position December 31, 2018 2 3 (In Millions) 4 Assets: 2017 Current Assets Cash and cash equivalents Short-term investments Accounts and notes receivable Inventories, at cost $ 4,333 845 3,400 433 $ 4,226 520 2,403 411 8 Prepaid expense and other current assets 10 11 1,638 10,649 1,555 6,804 303 $ 19,311 1,226 8,786 907 Total current assets 12 Property and equipment, net 13 Investments 5,199 155 $ 15,047 14 Other non-current assets 15 Total assets 16 Liabilities and stockholders' equity: Current liabilities Accounts payable Accrued and other liabilities Total current liabilities 17 18 19 $ 7,708 3,676 11,384 304 1,701 13,389 $ 6,009 3,033 9,042 305 1,179 10,526 20 21 Long-term debt Other non-current liabilities 22 23 Total liabilities 24 Stockholders' equity Preferred stock and capital in excess of $0.02 par value; 25 shares issued and outstanding: none Common stock and capital in excess of $0.05 par value; shares authorized: 6,000; shares issued: 2,163 and 1,903, respectively Treasury stock, at cost: 183 and 123 shares, respectively 26 27 28 29 7,803 (6,444) 4,676 (79) (34) 5,922 $ 19,311 7,001 (4,401) 1,990 (25) (44) 4,521 $ 15,047 30 Retained earnings 31 Other comprehensive loss 32 Other 34 Total stockholders' equity 35 Total liabilities and stockholders' equity 33 36 A1 Orlando Medical Corporation Consolidated Statements of Income Year ended December 31, 2018 3 (In Millions, Except per Share Amounts) 4 Net Revenue 5 Cost of goods sold Gross profit 7 Operating expenses: Selling, general, and administrative Research, development, and engineering 10 2017 2016 $ 42,666 35,147 7,519 $ 35,220 29,255 5,965 $ 31,111 25,492 5,619 6 3,341 544 3,250 553 2,985 536 Special charges 512 4,033 1,586 (30) 1,556 472 $ 1,084 11 Total operating expenses 3,885 3,634 153 3,803 2,162 196 12 Operating income 13 Investment and other income (loss), net 14 Income before income taxes 15 Income tax expense 16 3,787 1,136 $ 2,651 2,358 940 $ 1,418 Net income 17 Earnings per common share: 18 Basic 19 1.41 0.95 0.37

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 88% (9 reviews)

a Ac...View the full answer

Answered By

Gilbert Chesire

I am a diligent writer who understands the writing conventions used in the industry and with the expertise to produce high quality papers at all times. I love to write plagiarism free work with which the grammar flows perfectly. I write both academics and articles with a lot of enthusiasm. I am always determined to put the interests of my customers before mine so as to build a cohesive environment where we can benefit from each other. I value all my clients and I pay them back by delivering the quality of work they yearn to get.

4.80+

14+ Reviews

49+ Question Solved

Related Book For

Financial Accounting

ISBN: 978-0134725987

12th edition

Authors: C. William Thomas, Wendy M. Tietz, Walter T. Harrison Jr.

Question Posted:

Students also viewed these Business questions

-

Using the earliest year available as the base year, the trend percentage for Orlando Medicals net revenue during 2018 was a. 121%. b. up by 21.1%. c. up by $11,555 million. d. 137%. Use the Orlando...

-

Assume that you are considering purchasing stock as an investment. You have narrowed the choice to either Border Corporation stock or Celebration Company stock and have assembled the following data...

-

If you are using exponential smoothing for forecasting an annual time series of revenues, what is your forecast for next year if the smoothed value for this year is $32.4 million?

-

ABC Insurance Company has issued a commercial package policy to the Henderson Company. ABC recently discovered that company executives misrepresented important information about the business to...

-

For the matrices in Exercise 6, find a basis for the column space of A. (a) (b) 342 2 146 157 202 532 121

-

Explain each of the three jokes in the cartoon shown below. THE KID WHO LEARNED ABOUT MATH ON THE STREET If divide you 6,973 by 0, you die 00 Once, this guy tried to find the square root of 9, and...

-

Given the following data, calculate the gross margin and the net income. General and administrative expense = $300,000 Factory overhead = $700,000 Direct material = $900,000 Direct labor = $700,000...

-

The accountant for Ronaldo Company makes the assumptions or performs the activities listed below. Tell which of the following concepts of accrual accounting most directly relates to each assumption...

-

Required information The following information applies to the questions displayed below) A manufactured product has the following information for June Direct materials Olrect labor Overhead Undits...

-

You are a partner in a three-partner firm of accountants. The firm generates fees of approximately $1.4 million per annum. Within your portfolio of clients is Company A (a Unionized Company), which...

-

Orlando Medicals quick (acid-test) ratio at year-end 2018 is closest to a. 0.68. b. $8,578 million. c. 0.45. d. 0.75. Use the Orlando Medical Corporation financial statements that follow to answer...

-

Orlando Medicals common-size income statement for 2018 would report cost of goods sold as a. 82.4%. b. $35,147 million. c. up by 20.1%. d. 137.9%. Use the Orlando Medical Corporation financial...

-

Sometimes preparations of chymotrypsin are contaminated with small amounts of trypsin. This can be a problem if the specific hydrolysis of peptides with only chymotrypsin is desired. How could...

-

Among 450 randomly selected drivers in the 16 - 18 age bracket, 374 were in a car crash in the last year. If a driver in that age bracket is randomly selected, what is the approximate probability...

-

Construct a 90% confidence interval for the population standard deviation o at Bank A. Bank A 6.4 6.6 6.7 6.8 7.1 7.2 7.6 7.8 7.8 7.8

-

In 2002, after the accounting deceptions of the management of many multi-million dollar corporations (with Enron being the benchmark name of that time period), the Security and Exchange Commission...

-

1.Deduce the structure of a compound with molecular formula CsH100 that exhibits the following IR, H NMR, and 13C NMR spectra. Data from the mass spectrum are also provided. Mass Spec. Data relative...

-

Transcribed image text: Prots Caco.ch Part 2 Income Statement Med Earningstemet Tante Sheet For the event.com Competence ended The fram C an an dy wana A TO nede ANG ore.com wwwwww og for to...

-

A copper wire of length 3.0 m is observed to stretch by 2.1 mm when a weight of 120 N is hung from one end. (a) What is the diameter of the wire and what is the tensile stress in the wire? (b) If the...

-

Transform the while loop from the previous exercise into an equivalent for loop (make sure it produces the same output).

-

Describe the nature of the assets that compose the following sections of a balance sheet: (a) Current assets, (b) Property, plant, and equipment.

-

Describe the nature of the assets that compose the following sections of a balance sheet: (a) Current assets, (b) Property, plant, and equipment.

-

Can a business earn a gross profit but incur a net loss? Explain. Discuss.

-

Deacon Company is a merchandising company that is preparing a budget for the three - month period ended June 3 0 th . The following information is available Deacon Company Balance Sheet March 3 1...

-

Mango Company applies overhead based on direct labor costs. For the current year, Mango Company estimated total overhead costs to be $460,000, and direct labor costs to be $230,000. Actual overhead...

-

Which of the following do we expect to be the horizon growth rate for a company (long term growth rate- say 30-50 years)? A) Inflation B) Industry Average C) Zero D) Market Beta

Study smarter with the SolutionInn App