Find the Social Security and Medicare tax rates for the current year. Also find the maximum taxable

Question:

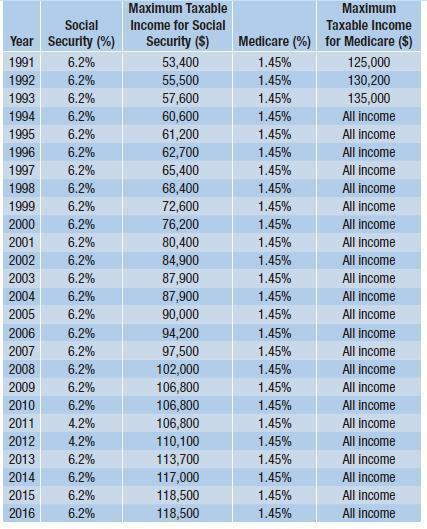

Find the Social Security and Medicare tax rates for the current year. Also find the maximum taxable income for the Social Security tax. Use the information to graph this year’s Social Security tax function.

Transcribed Image Text:

Social Year Security (%) 1991 6.2% 1992 6.2% 1993 6.2% 1994 6.2% 1995 6.2% 1996 6.2% 1997 6.2% 1998 6.2% 1999 6.2% 2000 6.2% 2001 6.2% 2002 6.2% 2003 6.2% 2004 6.2% 2005 6.2% 2006 6.2% 2007 6.2% 2008 6.2% 2009 6.2% 2010 6.2% 2011 4.2% 2012 4.2% 2013 6.2% 2014 6.2% 2015 6.2% 2016 6.2% Maximum Taxable Income for Social Security ($) 53,400 55,500 57,600 60,600 61,200 62,700 65,400 68,400 72,600 76,200 80,400 84,900 87,900 87,900 90,000 94,200 97,500 102,000 106,800 106,800 106,800 110,100 113,700 117,000 118,500 118,500 Medicare (%) 1.45% 1.45% 1.45% 1.45% 1.45% 1.45% 1.45% 1.45% 1.45% 1.45% 1.45% 1.45% 1.45% 1.45% 1.45% 1.45% 1.45% 1.45% 1.45% 1.45% 1.45% 1.45% 1.45% 1.45% 1.45% 1.45% Maximum Taxable Income for Medicare ($) 125,000 130,200 135,000 All income All income All income All income All income All income All income All income All income All income All income All income All income All income All income All income All income All income All income All income All income All income All income

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 57% (7 reviews)

ANSWER The Social Security tax rate for the current year is 62 for employees and ...View the full answer

Answered By

Aketch Cindy Sunday

I am a certified tutor with over two years of experience tutoring . I have a passion for helping students learn and grow, and I firmly believe that every student has the potential to be successful. I have a wide range of experience working with students of all ages and abilities, and I am confident that I can help students succeed in school.

I have experience working with students who have a wide range of abilities. I have also worked with gifted and talented students, and I am familiar with a variety of enrichment and acceleration strategies.

I am a patient and supportive tutor who is dedicated to helping my students reach their full potential. Thank you for your time and consideration.

0.00

0 Reviews

10+ Question Solved

Related Book For

Financial Algebra Advanced Algebra With Financial Applications

ISBN: 9781337271790

2nd Edition

Authors: Robert Gerver, Richard J. Sgroi

Question Posted:

Students also viewed these Mathematics questions

-

Download IRS Form 8919 (Uncollected Social Security and Medicare Tax on Wages) from the IRS website. According to the instructions, who should file this form?

-

Calculate the total Social Security and Medicare tax burden on a sole proprietorship earning 2015 profit of $300,000, assuming a single sole proprietor.

-

Calculate the total Social Security and Medicare tax burden on a sole proprietorship earning 2017 profit of $300,000, assuming a single sole proprietor?

-

Common structural steel can be represented on drawings using a letter, immediately followed by a number, then another number (for example, S14x30). The two numbers for a steel member W16x60 designate...

-

The Lanier Company produces a single product on three production lines. Because the lines were developed at different points in Laniers history, they use different equipment. The production manager...

-

Establish identity. (a sin + b cos ) 2 + (a cos - b sin ) 2 = a 2 + b 2

-

Imagine a one-period economy where the state-price deflator is lognormally distributed with E[ln ] = and Var[ln ] = 2 . What is the maximal Sharpe ratio of a risky asset? (Look at Eq. (4.8).)...

-

Industrial Technologies, Inc. (ITI), produces two compression machines that are popular with manufacturers of plastics: no. 165 and no. 172. Machine no. 165 has an average selling price of $30,000,...

-

Kansas applies a sales tax rate of 6.5% to all taxable items. In contrast, Illinois applies a sales tax rate of 6.25% for most taxable items but applies a rate of 1% when the tax base consists of...

-

On January 1, 2024, Power Ltd. issued bonds with a maturity value of $5 million for $4,797,000, when the market rate of interest was 8%. The bonds have a contractual interest rate of 7% and mature on...

-

In Dons state, unemployment compensation is calculated by finding the total of the quarterly wages of two consecutive quarters and dividing that amount by 26. The weekly unemployment amount is 47% of...

-

Margit works in a factory. She receives a salary of $12 per hour and piecework pay of 12 cents per unit produced. Last week she worked 38 hours and produced 755 units. a. What was her piecework pay?...

-

The tabular analysis of transactions for Wolfe Company is presented in E3-4. In E3-4. Instructions Prepare an income statement and a retained earnings statement for August and a classified balance...

-

The issue of Royal Rose Manufacturing Co., Ltd. with many new employees is the low level of production. Although the company implements training programs for employees, the skill improvement of...

-

For safety reasons an elevator stops with an acceleration of g/3 in the case of an emergency. Let's assume an unusually high ceiling of the elevator to hang three sections lamp one below the other...

-

Can Google be characterized as a monopoly? Justify your answer by specifying and comparing the characteristics of a monopoly with those of Google. What is competition law? How would you justify the...

-

In the case below design and draw a Rich Picture that identifies the key stakeholders, actors, power and decision-making authorities. The novel coronavirus has turned the world upside down as a...

-

1. Two spherical stars A and B have densities PA and PB, respectively. A and B have the same radius, and their masses MA and M are related by MB = 2M. Due to an interaction process, star A loses some...

-

Steve Drake sells a rental house on January 1, 2018, and receives $120,000 cash and a note for $45,000 at 10 percent interest. The purchaser also assumes the mortgage on the property of $35,000....

-

As indicated by mutual fund flows, investors tend to beat the market seek safety invest in last year's winner invest in last years loser

-

The Gallup poll in Exercise 2.40 asked American adults about their views on economic issues. The survey also asked which political party they supported. 1. Democrat 2. Independent 3. Republican Use a...

-

As of May 2016 the U.S. government owes $19,190,059,553,782. To whom does the U.S. government owe money? The list is shown below (in $billions). Use a graphical technique to depict these figures....

-

Refer to Exercise 2.55. Here is a list of the top 10 foreign governments that own the U.S. debt (in order of magnitude). Depict these figures with a graph. Government Debt China, mainland 1,254.8...

-

4 Exercise 9-6 (Algo) Lower of cost or market [LO9-1) 75 Tatum Company has four products in its inventory. Information about the December 31, 2021, Inventory is as follows: oints Product Total Cost...

-

A real estate investment is expected to return to its owner $3,500 per year for 16 years after expenses. At the end of year 16, the property is expected to be sold for $49,000. Assuming the required...

-

You borrowed $15,000 for buying a new car from a bank at an interest rate of 12% compounded monthly. This loan will be repaid in 48 equal monthly installments over four years. Immediately after the...

Study smarter with the SolutionInn App