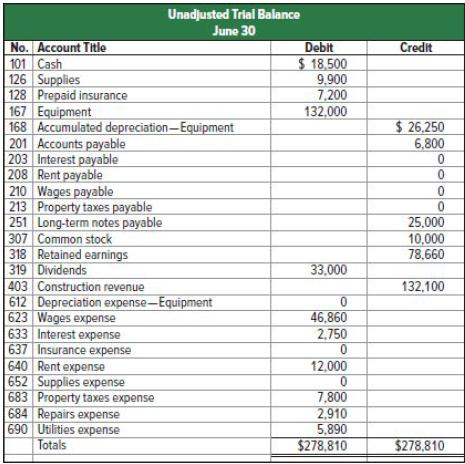

The following unadjusted trial balance is for Ace Construction Co. at its June 30 current fiscal year-end.

Question:

The following unadjusted trial balance is for Ace Construction Co. at its June 30 current fiscal year-end. The credit balance of the Retained Earnings account was $78,660 on June 30 of the prior year.

Required

1. Prepare and complete a 10-column work sheet for the current fiscal year, starting with the unadjusted trial balance and including adjustments using the following additional information.

a. Supplies available at the end of the current fiscal year total $3,300.

b. Cost of expired insurance for the current fiscal year is $3,800.

c. Annual depreciation on equipment is $8,400.

d. June utilities expense of $650 is not included in the unadjusted trial balance because the bill arrived after the trial balance was prepared. The $650 amount owed must be recorded.

e. Employees have earned $1,800 of accrued and unpaid wages at fiscal year-end.

f. Rent expense incurred and not yet paid or recorded at fiscal year-end is $500.

g. Additional property taxes of $1,000 have been assessed for this fiscal year but have not been paid or recorded at fiscal year-end.

h. $250 accrued interest for June has not yet been paid or recorded.

2. Using information from the completed 10-column work sheet in part 1, journalize the adjusting entries and the closing entries.

3. Prepare the income statement and the statement of retained earnings for the year ended June 30 and the classified balance sheet at June 30.

Step by Step Answer: