Answered step by step

Verified Expert Solution

Question

1 Approved Answer

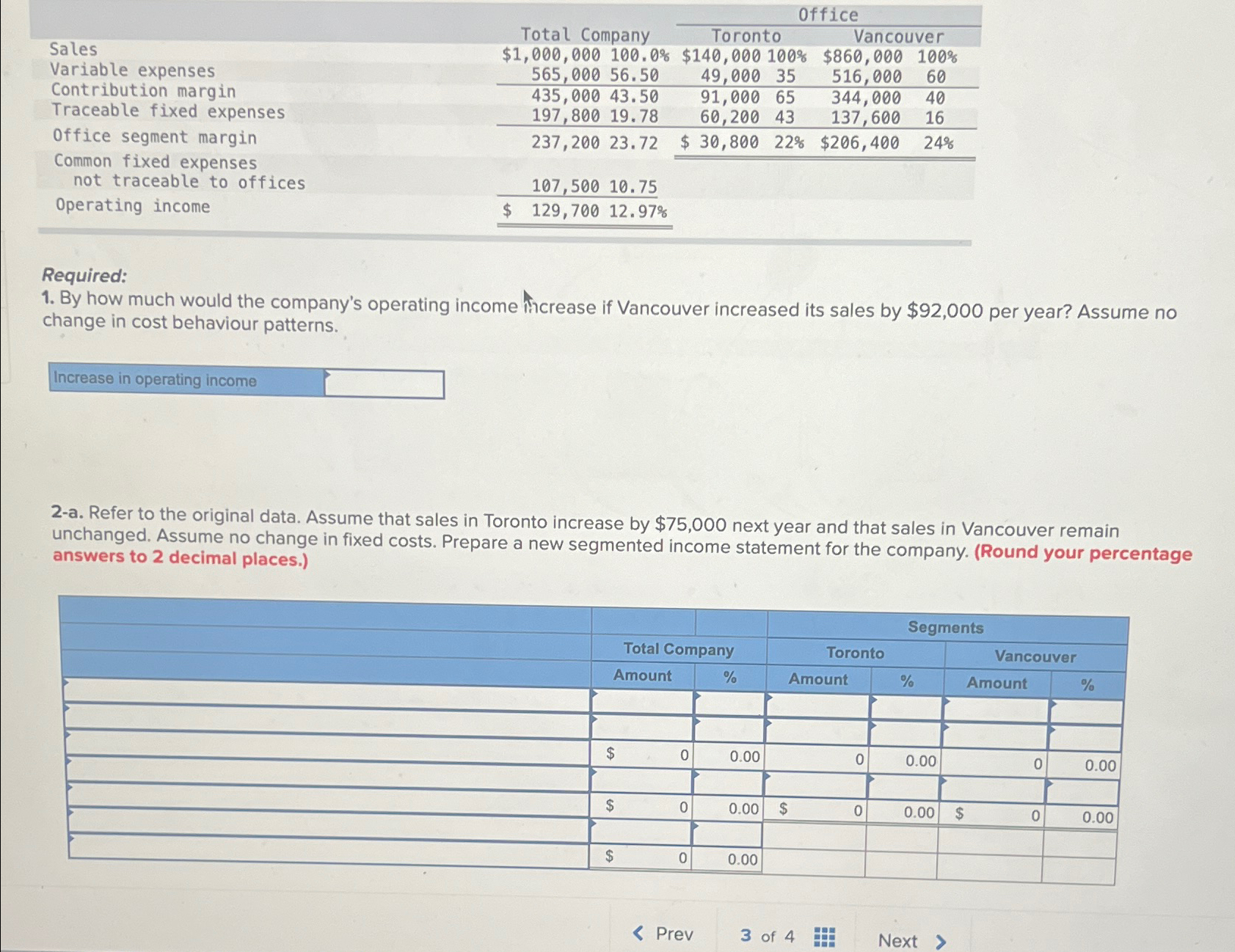

Sales Variable expenses Contribution margin Traceable fixed expenses Office segment margin Common fixed expenses not traceable to offices Operating income Total Company Toronto Office

Sales Variable expenses Contribution margin Traceable fixed expenses Office segment margin Common fixed expenses not traceable to offices Operating income Total Company Toronto Office Vancouver $1,000,000 100.0% $140,000 100% $860,000 100% 565,000 56.50 49,000 35 516,000 60 435,000 43.50 91,000 65 344,000 40 197,800 19.78 60,200 43 137,600 16 237,200 23.72 $ 30,800 22% $206,400 24% 107,500 10.75 $ 129,700 12.97% Required: 1. By how much would the company's operating income increase if Vancouver increased its sales by $92,000 per year? Assume no change in cost behaviour patterns. Increase in operating income 2-a. Refer to the original data. Assume that sales in Toronto increase by $75,000 next year and that sales in Vancouver remain unchanged. Assume no change in fixed costs. Prepare a new segmented income statement for the company. (Round your percentage answers to 2 decimal places.) Segments Total Company Toronto Vancouver Amount % Amount % Amount % $ 0 0.00 0 0.00 0 0.00 $ 0 0.00 $ 0 0.00 $ 0 0.00 $ 0 0.00 < Prev 3 of 4 www Next >

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started