Solve for the missing information pertaining to each investment proposal. Using the tables in Exhibits 263 and

Question:

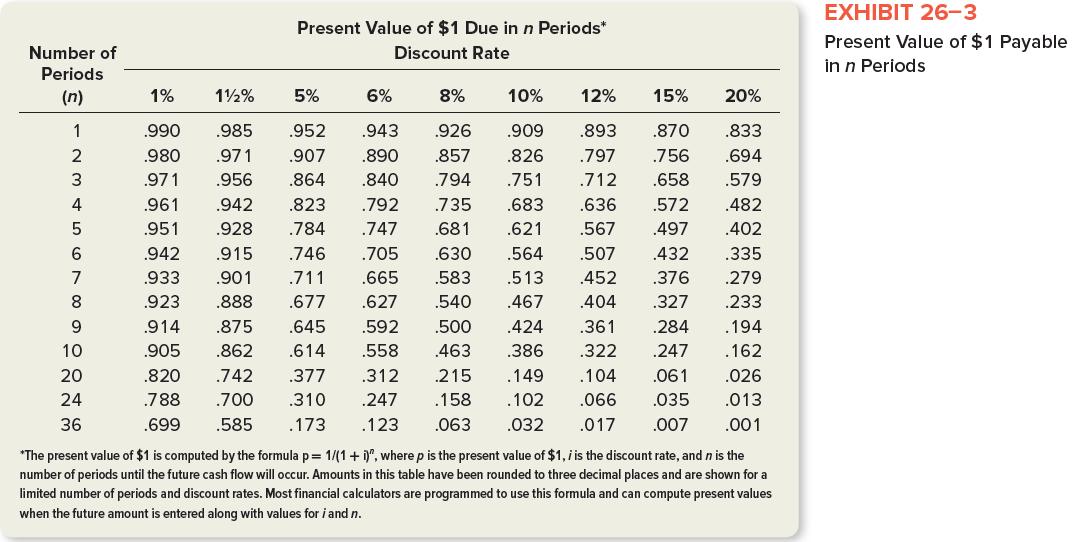

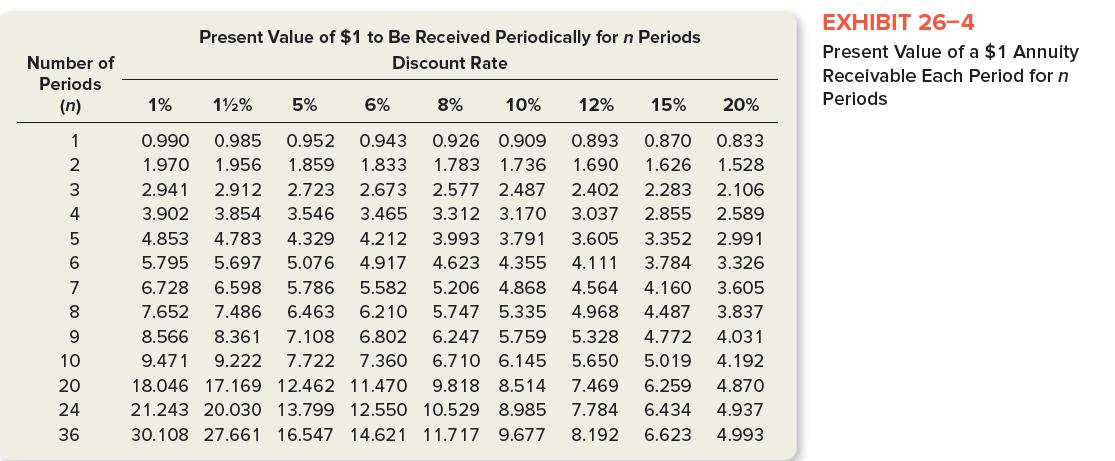

Solve for the missing information pertaining to each investment proposal. Using the tables in Exhibits 26–3 and 26–4, determine the present value of the following cash flows, discounted at an annual rate of 15 percent.

a. $60,000 to be received 20 years from today.

b. $32,000 to be received annually for 10 years.

c. $28,000 to be received annually for five years, with an additional $18,000 salvage value expected at the end of the fifth year.

d. $50,000 to be received annually for the first three years, followed by $40,000 received annually for the next two years (total of five years in which cash is received).

Number of Periods (n) 1 2 3 4 5 6 7 8 9 10 20 24 36 Present Value of $1 Due in n Periods* Discount Rate 1% .990 .980 .971 .961 .951 .942 .933 1½2% 5% 6% 8% 10% 12% 15% 20% .833 .985 .952 .943 .926 .909 .893 .870 .971 .907 .890 .857 .826 .797 .756 .694 .956 .864 .840 .794 .751 .712 .658 .579 .942 .823 .792 .735 .683 .636 .572 .482 .784 .747 .681 .621 .567 .497 .402 .928 .915 .746 .705 .564 .507 .432 .335 .376 .279 .923 .630 .901 .711 .665 .583 .513 .452 .888 .677 .627 .540 .467 .404 .914 .875 .645 .592 .500 .905 .862 .614 .558 .463 .327 .233 .424 .361 .284 .194 .386 .322 .247 .162 215 .149 .104 .061 .026 .820 .742 .377 .312 .700 .310 .247 .585 .173 .123 .788 .158 .102 .066 .035 .013 .699 .063 .032 .017 .007 .001 *The present value of $1 is computed by the formula p = 1/(1+i)", where p is the present value of $1, i is the discount rate, and n is the number of periods until the future cash flow will occur. Amounts in this table have been rounded to three decimal places and are shown for a limited number of periods and discount rates. Most financial calculators are programmed to use this formula and can compute present values when the future amount is entered along with values for i and n. EXHIBIT 26-3 Present Value of $1 Payable in n Periods

Step by Step Answer:

a 60000 061 3660 b 32000 5019 160608 c 28000 3352 18000 497 93...View the full answer

Financial And Managerial Accounting The Basis For Business Decisions

ISBN: 9781260247930

19th Edition

Authors: Jan Williams, Susan Haka, Mark Bettner, Joseph Carcello

Related Video

The present value of future cash flows is calculated to determine the value today of a stream of future cash flows. It is calculated by discounting the future cash flows to their present value using a discount rate. The discount rate reflects the time value of money and the risk of the cash flows. It is important because it helps in making investment decisions, capital budgeting, loan decision making, and financial planning. By discounting future cash flows to their present value using a discount rate, it takes into account the time value of money and the risk associated with the cash flows. This allows investors, lenders, and financial planners to evaluate the viability of potential investments, projects, or loan applications, and to estimate the future value of investments or savings. calculating the present value of future cash flows is important in making investment decisions, capital budgeting, loan decision making, and financial planning. It helps to determine the viability of long-term projects, evaluate loan applications, and estimate the future value of investments or savings.

Students also viewed these Business questions

-

Using the tables in Exhibits 263 and 264, determine the present value of the following cash flows, discounted at an annual rate of 15 percent: In Exhibits 263 In Exhibits 264 a. $10,000 to be...

-

Using the tables in Exhibits 26-3 and 26-4, determine the present value of the following cash flows, discounted at an annual rate of 15 percent. Exhibit 26-3: Present Value of $1 Payable in n Periods...

-

The following information relates to three independent investment decisions, each with a 10-year life and no salvage value : Using the present value tables in Exhibits 263 and 264, solve for the...

-

Fill in the blanks in the chart below: Year Years since 1960 1960 1965 1970 1975 1980 1985 1990 1995 1996 1997 1998 1999 2000 2001 2003 2005 2006 2007 2008 2009 2010 2011 0 5 [a] [b] [c] [d] [e] [f]...

-

Because of her past convictions for mail fraud and forgery, Jody has a 30% chance each year of having her tax returns audited. What is the probability that she will escape detection for at least...

-

Predict the major products formed when the following amines undergo exhaustive methylation, treatment with Ag2O, and heating. (a) Hexan-2-amine (b) 2-methylpiperidine (c) N-ethylpiperidine (d) (e)...

-

Which of the following represents an external challenge that a hospitality business may choose to address through training? A. A new dishwasher hired in the hotel food and beverage division has...

-

1. The burden of proof remains on the taxpayer for corporations, trusts, and partnerships with net worth exceeding: a. $1 million b. $3 million c. $5 million d. $7 million e. Some other amount 2. The...

-

Required a . Use the contribution margin approach to calculate the magnitude of operating leverage. b . Use the operating leverage measure computed in Requirement a to determine the amount of net...

-

Please solve this problem using C language Hacker Industries has a number of employees. The company assigns each employee a numeric evaluation score and stores these scores in a list. A manager is...

-

Nelson Equipment Company is evaluating two alternative investment opportunities. The controller of the company has prepared the following analysis of the two investment proposals. Items in addition...

-

Samba is a popular restaurant located in Brazilton Resort. Management feels that enlarging the facility to incorporate a large outdoor seating area will enable Samba to continue to attract existing...

-

A length of wire has a resistance of 120 . The wire is cut into N identical pieces which are then connected in parallel. The resistance of the parallel arrangement is 1.875 . Find N.

-

Significant Values. In Exercises 9-12, use the range rule of thumb to identify (a) the values that are significantly low, (b) the values that are significantly high, and (c) the values that are...

-

A study requires a group of 3 people to be interviewed from an organization with 50 members. How many groups of 3 are possible?

-

Univex is a calendar year, accrual basis retail business. Its financial statements provide the following information for the year: Revenues from sales of goods$783,200Cost of goods sold...

-

Write a 1,200-1,500-word paper. The Bureau of Justice Statistics (See link to the website in the Class Resources). The site contains an extensive list of reports published by the BJS along with links...

-

Arrest by Age and Gender in one city for small quantities of marijuana in 2000. Female Male Under 15 1 Under 15 18 15-19 48 15-19 452 20-24 25 20-24 94 25-29 9 25-29 115 30-34 6 30-34 93 35-39 6...

-

What is the significant difference between flexible spending arrangements (FSAs) and health savings accounts (HSAs)?

-

The Place-Plus real estate development firm in Problem 24 is dissatisfied with the economists estimate of the probabilities of future interest rate movement, so it is considering having a financial...

-

The year-end balance sheet of Smithfield Products includes the following stockholders equity section (with certain details omitted): Stockholders equity: 7 12% cumulative preferred stock, $100 par...

-

Parsons, Inc., is a publicly owned company. The following information is excerpted from a recent balance sheet. Dollar amounts (except for per share amounts) are stated in thousands. Stockholders...

-

Parsons, Inc., is a publicly owned company. The following information is excerpted from a recent balance sheet. Dollar amounts (except for per share amounts) are stated in thousands. Stockholders...

-

Accounting changes fall into one of three categories. Identify and explain these categories and give an example of each one.

-

Machinery is purchased on May 15, 2015 for $120,000 with a $10,000 salvage value and a five year life. The half year convention is followed. What method of depreciation will give the highest amount...

-

Flint Corporation was organized on January 1, 2020. It is authorized to issue 14,000 shares of 8%, $100 par value preferred stock, and 514,000 shares of no-par common stock with a stated value of $2...

Study smarter with the SolutionInn App