You are the controller for Foxboro Technologies. Your staff has prepared an income statement for the current

Question:

You are the controller for Foxboro Technologies. Your staff has prepared an income statement for the current year and has developed the following additional information by analyzing changes in the company’s balance sheet accounts.

Additional Information

1. Accounts receivable increased by $60,000.

2. Accrued interest receivable decreased by $5,000.

3. Inventory decreased by $30,000, and accounts payable to suppliers of merchandise decreased by $22,000.

4. Short-term prepayments of operating expenses increased by $8,000, and accrued liabilities for operating expenses decreased by $9,000.

5. The liability for accrued interest payable increased by $4,000 during the year.

6. The liability for accrued income taxes payable decreased by $10,000 during the year.

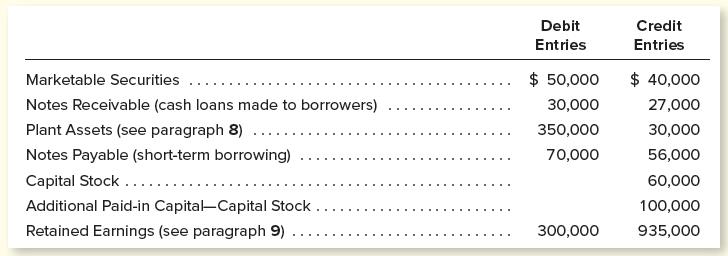

7. The following schedule summarizes the total debit and credit entries during the year in other balance sheet accounts.

8. The $30,000 in credit entries to the Plant Assets account is net of any debits to Accumulated Depreciation when plant assets were retired. Thus the $30,000 in credit entries represents the book value of all plant assets sold or retired during the year.

9. The $300,000 debit to Retained Earnings represents dividends declared and paid during the year. The $935,000 credit entry represents the net income shown in the income statement.

10. All investing and financing activities were cash transactions.

11. Cash and cash equivalents amount to $20,000 at the beginning of the year and to $473,000 at year-end.

Instructions

a. Prepare a statement of cash flows for the current year. Use the direct method of reporting cash flows from operating activities. Place brackets around dollar amounts representing cash outflows. Show separately your computations of the following amounts.

1. Cash received from customers.

2. Interest received.

3. Cash paid to suppliers and employees.

4. Interest paid.

5. Income taxes paid.

6. Proceeds from sales of marketable securities.

7. Proceeds from sales of plant assets.

8. Proceeds from issuing capital stock.

b. Explain why cash paid to suppliers is so much higher than cost of goods sold.

c. Does the fact that Foxboro’s cash flows from both investing and financing activities are negative indicate that the company is in a weak cash position?

Step by Step Answer:

Financial And Managerial Accounting The Basis For Business Decisions

ISBN: 9781260247930

19th Edition

Authors: Jan Williams, Susan Haka, Mark Bettner, Joseph Carcello