Idaho Refrigeration has these account balances at December 31, 2025: Requirements 1. Calculate Idaho Refrigerations current ratio.

Question:

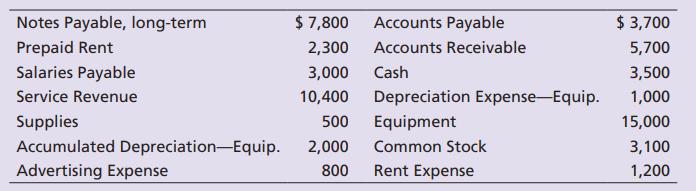

Idaho Refrigeration has these account balances at December 31, 2025:

Requirements

1. Calculate Idaho Refrigeration’s current ratio.

2. How much in current assets does Idaho Refrigeration have for every dollar of current liabilities that it owes?

Transcribed Image Text:

Notes Payable, long-term Prepaid Rent Salaries Payable Service Revenue Supplies Accumulated Depreciation-Equip. Advertising Expense $ 7,800 2,300 3,000 10,400 500 2,000 800 Accounts Payable Accounts Receivable Cash Depreciation Expense-Equip. Equipment Common Stock Rent Expense $ 3,700 5,700 3,500 1,000 15,000 3,100 1,200

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 77% (9 reviews)

To calculate Idaho Refrigerations current ratio we need to divide its current assets by its current ...View the full answer

Answered By

Surendar Kumaradevan

I have worked with both teachers and students to offer specialized help with everything from grammar and vocabulary to challenging problem-solving in a range of academic disciplines. For each student's specific needs, I can offer explanations, examples, and practice tasks that will help them better understand complex ideas and develop their skills.

I employ a range of techniques and resources in my engaged, interesting tutoring sessions to keep students motivated and on task. I have the tools necessary to offer students the support and direction they require in order to achieve, whether they need assistance with their homework, test preparation, or simply want to hone their skills in a particular subject area.

0.00

0 Reviews

10+ Question Solved

Related Book For

Horngrens Financial And Managerial Accounting The Financial Chapters

ISBN: 9780137858651

8th Edition

Authors: Tracie Miller Nobles, Brenda Mattison

Question Posted:

Students also viewed these Business questions

-

End of the Line Montana Refrigeration has these account balances at December 31, 2024: Requirements 1. Calculate End of the Line Montana Refrigerations current ratio. 2. How much in current assets...

-

Heart of Texas Telecom has these account balances at December 31, 2012: Requirements 1. Compute Heart of Texas Telecoms current ratio and debt ratio. 2. How much in current assets does Heart of Texas...

-

Heart of Tennessee Telecom has these account balances at December 31, 2016: Notes Payable, long-term.......$ 8,500 Prepaid Rent............... 1,500 Salaries Payable........... 1,200 Service...

-

You are to show the journal entries necessary to record the following items which occured in 2012: (a) May 1 Bought a van on credit from Deedon Garage for 6,000. (b) May 3 A debt of 100 owing from P....

-

What are the key conditions or circumstances that must be present for a company to be auditable? What uncommon challenges to audit ability are posed by Chinese companies?

-

Repeat Exercise with the followingfrequencies: Cell 1 2 3 4 5 Frequency 12 32 42 36 28

-

Does the production-operations process work smoothly and with little disruption?

-

The intangible assets section of Redeker Company at December 31, 2010, is presented below. Patent ($70,000 cost less $7,000 amortization)..... $63,000 Franchise ($48,000 cost less $19,200...

-

For each of the following transactions (a) through for Catena's Marketing Company, prepare the adjusting entry. The process includes (1) determining if revenue was earned or an expense was incurred,...

-

Sprouts Farmers Market Wendys Company QUESTION The COVID-19 pandemic affected companies in the food industry in unique ways, particularly during 2020. Ruth's Hospitality Group (Ticker:...

-

The net income of Steinbach & Sons, a landscaping company, decreased sharply during 2025. Mort Steinbach, owner and manager of the company, anticipates the need for a bank loan in 2026. Late in 2025,...

-

The adjusted trial balance of Vinnys Dance Studio Company follows: Requirements 1. Prepare the classified balance sheet of Vinnys Dance Studio Company at August 31, 2025. Use the report form. You...

-

(This problem requires some knowledge of portfolio calculations covered in Chapter 8.) Below you will find data on the returns, E r( ) A and E r( ) B , and standard deviations, A and B, of stocks A...

-

Salinger Company estimates that total factory overhead costs will be $70,000 for the year. Direct labor hours are estimated to be 10,000. a. For Salinger Company, determine the predetermined factory...

-

SCS receives on average 1 data package every 1/50 seconds, with a standard deviation of 1/50 seconds, and processes them using its single powerful computing unit, which can process data packages in...

-

Suppose that we pay workers $25 per day.We value processed orders at $4 per order and the number of orders each worker can process is worker 1 - 8 orders, worker 2 - 7 orders, worker 3 - 6 orders,...

-

How do I imagine that I am the administrator of a midsize long-term care facility with an outdated information system and I have been given thetaskto planand managethe integration of a new database...

-

You are negotiating a five - year contract with a new customer. The contract could be larger than any previous contracts your company has had. Which would be your best negotiation style?

-

The firm is planning on receiving a regulatory permission to sell its product in different regulated markets. The details are presented in Table 1. The marketing department conducted research and...

-

Juanita owns a home in Richardson, TX. She purchases a Homeowners Policy (HO-3) from Farm State Ins. Co. The policy provides $100,000 in liability coverage (coverage E) and $5,000 in Med Pay coverage...

-

Consider the following transactions of Sapphire Software: Mar. 31 Recorded cash sales of $230,000, plus sales tax of 7% collected for the state of New Jersey. Apr. 6 Sent March sales tax to the...

-

Watson Publishing completed the following transactions during 2018: Oct. 1 Sold a six-month subscription (starting on November 1), collecting cash of $240, plus sales tax of 8%. Nov. 15 Remitted...

-

On July 5, Williams Company recorded sales of merchandise inventory on account, $55,000. The sales were subject to sales tax of 4%. On August 15, Williams Company paid the sales tax owed to the state...

-

Product Weight Sales Additional Processing Costs P 300,000 lbs. $ 245,000 $ 200,000 Q 100,000 lbs. 30,000 -0- R 100,000 lbs. 175,000 100,000 If joint costs are allocated based on relative weight of...

-

The projected benefit obligation was $380 million at the beginning of the year. Service cost for the year was $21 million. At the end of the year, pension benefits paid by the trustee were $17...

-

CVP Modeling project The purpose of this project is to give you experience creating a multiproduct profitability analysis that can be used to determine the effects of changing business conditions on...

Study smarter with the SolutionInn App