1.Consider a $1000 bond with a fixed-rate 10 per cent annual coupon rate and a maturity (N...

Question:

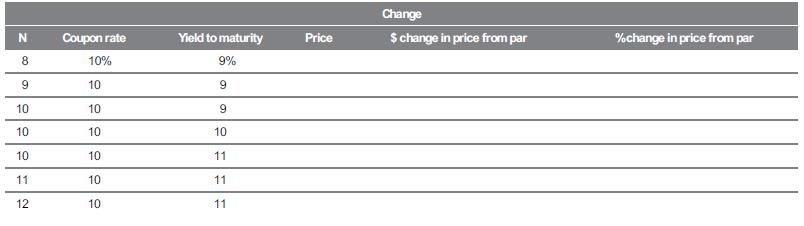

1.Consider a $1000 bond with a fixed-rate 10 per cent annual coupon rate and a maturity (N ) of 10 years. The bond currently is trading at a yield to maturity (YTM ) of 10 per cent.

Complete the table:

Use this information to verify the principles of interest rate–price relationships for fixed-rate financial assets. LO 6.4 The following questions and problems are based on material in Appendix 6B at the end of the chapter.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Financial Institutions Management A Risk Management

ISBN: 9781743073551

4th Edition

Authors: Helen Lange, Anthony Saunders, Marcia Millon Cornett

Question Posted: