1.Export Bank has a trading position in Japanese yen and Swiss francs. At the close of business...

Question:

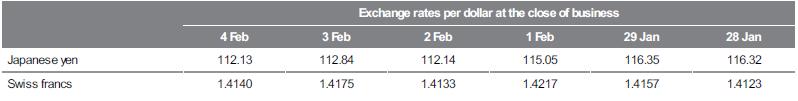

1.Export Bank has a trading position in Japanese yen and Swiss francs. At the close of business on 4 February the bank had ¥300 000 000 and SF10 000 000. The exchange rates for the most recent six days are given below:

What is the foreign exchange (FX) position in dollar equivalents using the FX rates on 4 February?

What is the definition of delta as it relates to the FX position?

What is the sensitivity of each FX position; that is, what is the value of delta for each currency on 4 February?

What is the daily percentage change in exchange rates for each currency over the five-day period?

What is the total risk faced by the bank on each day? What is the worst-case day? What is the best-case day?

Assume that you have data for the 500 trading days preceding 4 February. Explain how you would identify the worst-case scenario with a 95 per cent degree of confidence.

Explain how the 5 per cent value at risk (VaR) position would be interpreted for business on 5 February.

How would the simulation change at the end of the day on 5 February? What variables and/or processes in the analysis may change? What variables and/or processes will not change? LO 9.5

Step by Step Answer:

Financial Institutions Management A Risk Management

ISBN: 9781743073551

4th Edition

Authors: Helen Lange, Anthony Saunders, Marcia Millon Cornett