A securities firm has the following balance sheet (in millions): The debt securities have a coupon rate

Question:

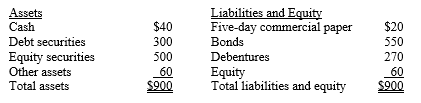

A securities firm has the following balance sheet (in millions):

The debt securities have a coupon rate of 6 percent, 20 years remaining until maturity, and trade at a yield of 8 percent. The equity securities have a market value equal to book value, and the other assets represent building and equipment which was recently appraised at $80 million. The company has 1 million shares of stock outstanding and its price is $62 per share. Is this company in compliance with SEC Rule 15C 3-1?

Balance SheetBalance sheet is a statement of the financial position of a business that list all the assets, liabilities, and owner’s equity and shareholder’s equity at a particular point of time. A balance sheet is also called as a “statement of financial... Coupon

A coupon or coupon payment is the annual interest rate paid on a bond, expressed as a percentage of the face value and paid from issue date until maturity. Coupons are usually referred to in terms of the coupon rate (the sum of coupons paid in a...

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Financial Institutions Management A Risk Management Approach

ISBN: 978-1259717772

9th edition

Authors: Anthony Saunders, Marcia Millon Cornett

Question Posted: