1. The Connecticut Computer Company has the following selected financial results. The company is considering a capital...

Question:

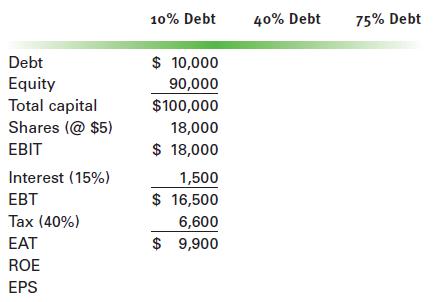

1. The Connecticut Computer Company has the following selected financial results.

The company is considering a capital restructuring to increase leverage from its present level of 10% of capital.

a. Calculate Connecticut’s ROE and EPS under its current capital structure.

b. Restate the financial statement line items shown, the number of shares outstanding, ROE, and EPS if Connecticut borrows money and uses it to retire stock until its capital structure is 40% debt assuming EBIT remains unchanged and the stock continues to sell at its book value. (Develop the second column of the chart shown.)

c. Recalculate the same figures assuming Connecticut continues to restructure until its capital structure is 75% debt. (Develop the third column of the chart.)

d. How is increasing leverage affecting financial performance? What overall effect might the changes have on the market price of Connecticut’s stock? Why?

(Words only. Hint: Consider the move from 10% to 40% and that from 40% to 75% separately.)

Step by Step Answer: