15. The Hamilton Corp. has 35,000 shares of common stock outstanding with a book value of $20...

Question:

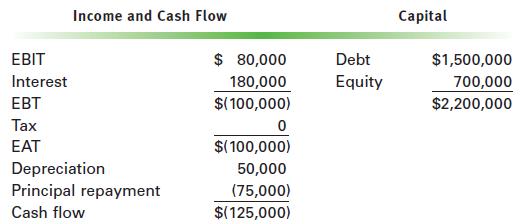

15. The Hamilton Corp. has 35,000 shares of common stock outstanding with a book value of $20 per share. It owes creditors $1.5 million at an interest rate of 12%.

Selected financial results are as follows.

Restructure the financial line items shown assuming a composition in which creditors agree to convert two-thirds of their debt into equity at book value.

Assume Hamilton will pay tax at a rate of 15% on income after the restructuring, and that principal repayments are reduced proportionately with debt. Who will control the company, and by how big a margin after the restructuring?

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Question Posted: