17. The Singleton Metal Stamping Company is planning to buy a new computercontrolled stamping machine for $10

Question:

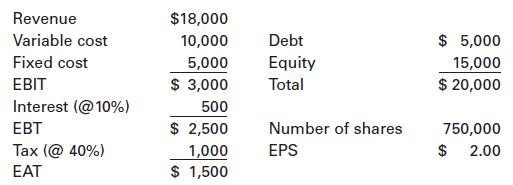

17. The Singleton Metal Stamping Company is planning to buy a new computercontrolled stamping machine for $10 million. The purchase will be financed entirely with borrowed money, which will change Singleton’s capital structure substantially. It will also change operations by adding $1.5 million in fixed cost and eliminating $2 million in variable cost at the current level of sales. The firm’s current financial position is reflected in the following statement ($000).

a. Restate the financial statements with the new machine, and calculate the dollar breakeven points with and without it.

b. Calculate the DFL with and without the new machine.

c. Calculate the DOL with and without the new machine. (Hint: You don’t need Q to use equation 14.11, because PQ is revenue and VQ is total variable cost.)

d. Calculate the DTL with and without the new machine.

e. Comment on the variability of EPS with sales and the source of that variability.

f. Is it a good idea to buy the new machine if sales are expected to remain near current levels? Give two reasons why or why not. What has to be anticipated for the project to make sense?

Step by Step Answer: