20. Segwick Corp. manufactures mens shoes, which it sells through its own chain of retail stores. The

Question:

20. Segwick Corp. manufactures men’s shoes, which it sells through its own chain of retail stores. The firm is considering adding a line of women’s shoes.

Management considers the project a new venture because there are substantial differences in marketing and manufacturing processes between men’s and women’s footwear.

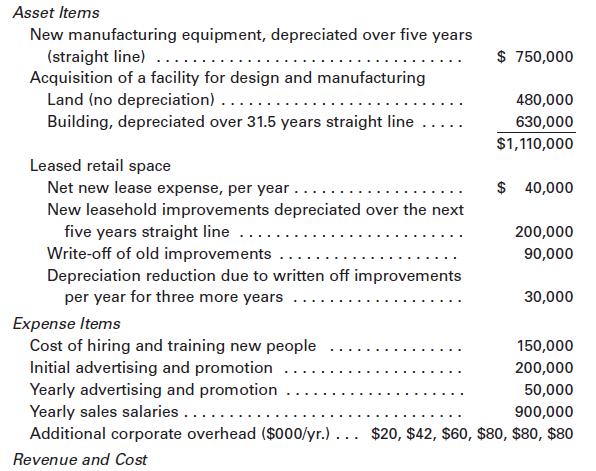

The project will involve setting up a manufacturing facility as well as expanding or modifying the retail stores to carry two products. The stores are leased, so modification will involve leasing larger spaces, installing new leasehold improvements, and writing off some old leasehold improvements.2 The expected costs are summarized as follows.

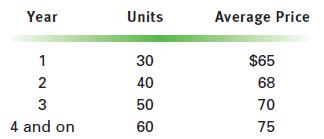

The unit sales forecast is as follows in thousands.

Direct cost excluding depreciation is 40% of sales.

Working Capital Sales are to retail customers who pay with checks or credit cards. It takes about 10 days to clear both of these and actually receive cash.

Inventories are estimated to be approximately the direct cost of two months’ sales.

Payables are estimated as one quarter of inventories.

Estimate the current accounts based on the current year’s sales and cost levels.

Assume incremental cash is required equal to 2% of revenues.

Accruals are insignificant.

Other Items Management expects a few of the company’s current male customers to be lost because they won’t want to shop in a store that doesn’t exclusively sell men’s shoes. The gross margin impact of these lost sales is estimated to be $60,000 per year.

The company has already purchased designs for certain styles of ladies’

shoes for $60,000.

Segwick’s cost of capital is 10%. Its marginal tax rate is 35%.

a. Develop a six-year forecast of after-tax cash flows for Segwick.

b. Calculate the project’s payback period, NPV, IRR, and PI, and make a recommendation about acceptance.

c. Assume you are told that the men’s shoe industry is very stable, being served by the same manufacturers year after year. However, firms enter and leave the ladies’ shoe business regularly. Would this knowledge make you more or less comfortable with the analysis you’ve done of this project? Why?

Step by Step Answer: