Complete the balance sheet and sales information in the table that follows for Hoffmeister Industries using the

Question:

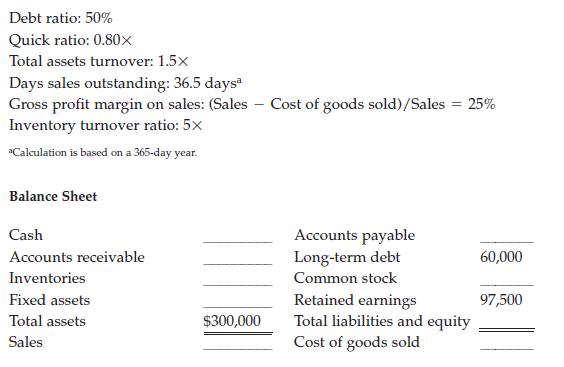

Complete the balance sheet and sales information in the table that follows for Hoffmeister Industries using the following financial data:

Transcribed Image Text:

Debt ratio: 50% Quick ratio: 0.80x Total assets turnover: 1.5x Days sales outstanding: 36.5 daysª Gross profit margin on sales: (Sales - Cost of goods sold)/Sales = 25% Inventory turnover ratio: 5x "Calculation is based on a 365-day year. Balance Sheet Cash Accounts receivable Inventories Fixed assets Total assets Sales $300,000 Accounts payable Long-term debt Common stock Retained earnings Total liabilities and equity Cost of goods sold 60,000 97,500

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 75% (4 reviews)

To complete the balance sheet and sales information we can use the given financial ratios and the partial balance sheet Lets go through the calculations step by step 1 Debt Ratio The debt ratio is the ...View the full answer

Answered By

PALASH JHANWAR

I am a Chartered Accountant with AIR 45 in CA - IPCC. I am a Merit Holder ( B.Com ). The following is my educational details.

PLEASE ACCESS MY RESUME FROM THE FOLLOWING LINK: https://drive.google.com/file/d/1hYR1uch-ff6MRC_cDB07K6VqY9kQ3SFL/view?usp=sharing

3.80+

3+ Reviews

10+ Question Solved

Related Book For

Financial Management Theory & Practice

ISBN: 9780324652178

12th Edition

Authors: Eugene BrighamMichael Ehrhardt

Question Posted:

Students also viewed these Business questions

-

Complete the balance sheet and sales information in the table that follows for J. White Industries using the following financial data: Total assets turnover: 1.5 Gross profit margin on sales: (Sales...

-

Complete the balance sheet and sales information in the table that follows for Hoffmeister Industries using the following financial data: Debt ratio: 50% Quick ratio: 0.80X Total assets turnover:...

-

Complete the balance sheet and sales information in the table that follows for J. White Industries (a). Total assets turnover 1.5 (b). Gross profit margin on sales (Sales-cost of good sold)/Sales =...

-

Accounting Today identified top accounting firms in 10 geographic regions across the United States. All 10 regions reported growth in 2016. The Southeast and Gulf Coast regions reported growths of...

-

Consider the following payoff matrix: a. Does Player A have a dominant strategy? Explain why or why not. b. Does Player B have a dominant strategy? Explain why or whynot. Player B Strategy $1,000...

-

Sorting through unsolicited e-mail and spam affects the productivity of office workers. An InsightExpress survey monitored office workers to determine the unproductive time per day devoted to...

-

An MBAs work-life balance. Many business schools offer courses that assist MBA students with developing good work-life balance habits and most large companies have developed work-life balance...

-

Rocky Guide Service provides guided 1-5 day hiking tours throughout the Rocky Mountains. Wilderness Tours hires Rocky to lead various tours that Wilderness sells. Rocky receives $1,000 per tour day,...

-

On 1 June 2020 Charm issued 100 options to 10,000 of its employees. The fair value of each option at the grant date was 20. On this date the market value of Charms shares was 30 per share. The shares...

-

Data for Morton Chip Company and its industry averages follow. a. Calculate the indicated ratios for Morton. b. Construct the extended Du Pont equation for both Morton and the industry. c. Outline...

-

The following data apply to Jacobus and Associates (millions of dollars): Jacobus has no preferred stockonly common equity, current liabilities, and longterm debt. a. Find Jacobuss (1) accounts...

-

Denise owns Gal Corp. stock which she purchased ten years ago for \(\$ 370,000\). Pursuant to a plan of corporate reorganization, Gal Corp. will be merged into Lewis Corp. As a result of the merger,...

-

Write out the form of the partial fraction decomposition of the function (see example). Do not determine the numerical values of the coefficients. x3 (a) x + 7x+6 9x+1 (b) (x + 1)3(x + 2) Submit...

-

You desire to make an 80% by weight vinyl acetate to 20% by weight styrene copolymer via free radical, emulsion polymerization. The r 1 and r 2 values for these monomers are 0.01 and 55,...

-

Q1)In a wheel and axle machine the diameters of the wheel and the axle are 450mm and 60mm respectively.The efficiency is 97%(0.97 per unit).When a body having a mass of 40kg is being lifted.Determine...

-

Smith & Chief Ltd. of Sydney, Australia, is a merchandising firm that is the sole distributor of a product that is increasing in popularity among Australian consumers. The company's income statements...

-

C. In lab, you measure the x & y components of a possible incompressible flow field as u = 2cxy; and where cand a are constants. v = c(a + x - y) 5. (04 pts) Short answer, what is necessary for the...

-

Montal Inc. can produce three different products interchangeably on two machines. The accounting department provides the following information on these products: The total machine hours available are...

-

On 1 July 2021, Croydon Ltd leased ten excavators for five years from Machines4U Ltd. The excavators are expected to have an economic life of 6 years, after which time they will have an expected...

-

Why is EBIT generally considered independent of financial leverage? Why might EBIT actually be affected by financial leverage at high debt levels?

-

Is the debt level that maximizes a firms expected EPS the same as the debt level that maximizes its stock price? Explain.

-

When the Bell System was broken up, the old AT&T was split into a new AT&T in addition to seven regional telephone companies. The specific reason for forcing the breakup was to increase the degree of...

-

Hite corporation intends to issue $160,000 of 5% convertible bonds with a conversion price of $40 per share. The company has 40,000 shares of common stock outstanding and expects to earn $600,000...

-

Your portfolio has a beta of 1.17, a standard deviation of 14.3 percent, and an expected return of 12.5 percent. The market return is 11.3 percent and the risk-free rate is 3.1 percent. What is the...

-

Slow Roll Drum Co. is evaluating the extension of credit to a new group of customers. Although these customers will provide $198,000 in additional credit sales, 13 percent are likely to be...

Study smarter with the SolutionInn App