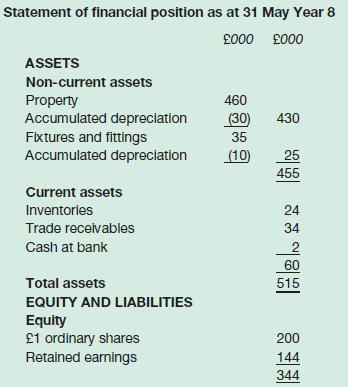

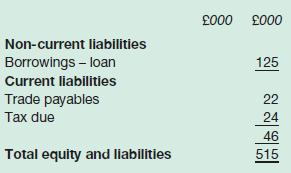

Quardis Ltd is a small business that imports high-quality laser printers. The most recent statement of financial

Question:

Quardis Ltd is a small business that imports high-quality laser printers. The most recent statement of financial position of the business is as follows:

The following forecast information is available for the year ending 31 May Year 9:

1. Sales are expected to be £280,000 for the year. Sixty per cent of sales are on credit and it is expected that, at the year-end, three months’ credit sales will be outstanding. Sales revenues accrue evenly over the year.

2. Purchases of inventories during the year will be £186,000 and will accrue evenly over the year. All purchases are on credit and at the year-end it is expected that two months’ purchases will remain unpaid.

3. Fixtures and fittings costing £25,000 will be purchased and paid for during the year. Depreciation is charged at 10 per cent on the cost of fixtures and fittings held at the year-end.

4. Depreciation is charged on property at 2 per cent on cost.

5. On 1 June Year 8, £30,000 of the loan from the Highland Bank is to be repaid. Interest is at the rate of 13 per cent per year and all interest accrued to 31 May Year 9 will be paid on that day.

6. Inventories at the year-end are expected to be 25 per cent higher than at the beginning of the year.

7. Wages for the year will be £34,000. It is estimated that £4,000 of this total will remain unpaid at the year-end.

8. Other overhead expenses for the year (excluding those mentioned above) are expected to be £21,000. It is estimated that £3,000 of this total will still be unpaid at the year-end.

9. A dividend of 5p per share will be announced and paid during the year.

10. Tax is payable at the rate of 35 per cent. Tax outstanding at the beginning of the year will be paid during the year. Half of the tax relating to the year will also be paid during the year.

Required:

(a) Prepare a projected income statement for the year ending 31 May Year 9.

(b) Prepare a projected statement of financial position as at 31 May Year 9.

(c) Comment on the significant features revealed by these statements.

All workings should be shown to the nearest £000.

Step by Step Answer: