10. Using the information below, please answer the following questions below about Surelock Homes, a start-up company....

Question:

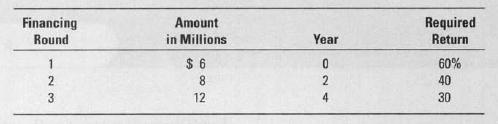

10. Using the information below, please answer the following questions below about Surelock Homes, a start-up company. In your analysis, assume the valuation date is the end of year 6, projected earnings in year 6 will be $12 million, and an appropriate price-to-earnings ratio for valuing these earnings is 20 times.

In addition, the company wants to reserve 15 percent of the shares outstanding at time 6 for employee bonuses and options.

a. What percentage ownership at time 0 should round 1 investors demand for their $6 million investment?

b. If Surelock presently has 1 million shares outstanding, how many shares should round 1 investors demand at time 0?

c. What is the implied price per share of Surelock stock at time 0?

d. What is Surelock's premoney value at time 0? What is its postmoney value?

Step by Step Answer: