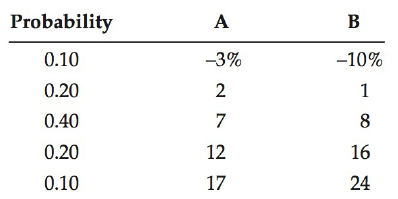

The following table shows the annual returns over time for two stocks. Calculate each stock's expected return,

Question:

The following table shows the annual returns over time for two stocks.

Calculate each stock's expected return, standard deviation, and coefficient of variation.

Transcribed Image Text:

Probability A B -10% 0.10 -3% 0.20 2 0.40 12 0.20 16 0.10 17 24

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 82% (17 reviews)

r A 013 022 047 0212 0117 7 r B 0110 021 048 0201...View the full answer

Answered By

JAPHETH KOGEI

Hi there. I'm here to assist you to score the highest marks on your assignments and homework. My areas of specialisation are:

Auditing, Financial Accounting, Macroeconomics, Monetary-economics, Business-administration, Advanced-accounting, Corporate Finance, Professional-accounting-ethics, Corporate governance, Financial-risk-analysis, Financial-budgeting, Corporate-social-responsibility, Statistics, Business management, logic, Critical thinking,

So, I look forward to helping you solve your academic problem.

I enjoy teaching and tutoring university and high school students. During my free time, I also read books on motivation, leadership, comedy, emotional intelligence, critical thinking, nature, human nature, innovation, persuasion, performance, negotiations, goals, power, time management, wealth, debates, sales, and finance. Additionally, I am a panellist on an FM radio program on Sunday mornings where we discuss current affairs.

I travel three times a year either to the USA, Europe and around Africa.

As a university student in the USA, I enjoyed interacting with people from different cultures and ethnic groups. Together with friends, we travelled widely in the USA and in Europe (UK, France, Denmark, Germany, Turkey, etc).

So, I look forward to tutoring you. I believe that it will be exciting to meet them.

3.00+

2+ Reviews

10+ Question Solved

Related Book For

Financial Management Theory And Practice

ISBN: 978-0176583057

3rd Canadian Edition

Authors: Eugene Brigham, Michael Ehrhardt, Jerome Gessaroli, Richard Nason

Question Posted:

Students also viewed these Business questions

-

Based on the information in Problem 7-7, if a portfolio is made up of 40% of stock A and 60% of stock B: a. Calculate the portfolio's expected rate of return. b. Calculate the portfolio's standard...

-

The following table shows the annual returns on a portfolio of small stocks during the 20-year period from 1976 to 1995. What is the average return and standard deviation of this portfolio? How do...

-

Many more types of investments are available besides stocks, bonds, and cash securities. Many people invest in real estate and in precious metals, primarily gold. What are the risk and return...

-

The B.B. Lean Co. has 1.4 million shares of stock outstanding. The stock currently sells for $20 per share. The firm's debt is publicly traded and was recently quoted at 93 percent of face value. It...

-

You have been asked to produce a forecast for your company's product, bottled water. Discuss the kind of information you would look for in order to make this forecast.

-

Use the statistical feature of a calculator to find the mean and the standard deviation s for the indicated sets of numbers. Set C C: 0.48, 0.53, 0.49, 0.45, 0.55, 0.49, 0.47, 0.55, 0.48, 0.57, 0.51,...

-

Suppose you conduct a 4 * 3 factorial experiment. a. How many factors are used in this experiment? b. Can you determine the type(s) of factorsqualitative or quantitativefrom the information given?...

-

Official Reserve Rare Coins (ORRC) was formed on January 1, 2016. Additional data for the year follow: a. On January 1, 2016, ORRC issued no par common stock for $450,000. b. Early in January, ORRC...

-

On June 2 , Fat Tires Ltd. borrowed $10000 with an interest rate of 5.3%. The loan was repaid in full on November 14, with payments of $2900 on September 1 and $3500 on October 3. What was the final...

-

Mary James owns Mary s Card House in Halifax. As her newly hired accountant, your task is to: a. Journalize the following transactions for the month of March. b. Record in subsidiary ledgers and post...

-

The market and Stock J have the following probability distributions: a. Calculate the expected rates of return for the market and Stock J. b. Calculate the standard deviations for the market and...

-

Suppose you hold a diversified portfolio consisting of a $10,000 investment in each of 20 different common stocks. The portfolio beta is equal to 1.20. Now, suppose you have decided to sell one of...

-

a. Let (e1, e2, e2) be unit vectors of a right-handed, orthogonal coordinate system. Showthat the Levi-Civit`a symbol satisfies b. Prove that c. Prove that: d. In quantum mechanics, the Cartesian...

-

What is the research question or objective? What research methods did the authors use? Examples include survey, case study, interviews, opinions, qualitative, quantitative, etc. What are the...

-

Provide a critical reflection on each department outlining which services, aspects and operational factors you should further investigate to help improve customer satisfaction. Express the negative...

-

1. Many courses use group projects. What are some of the things that make positive group project experiences? 2. How can a manager motivate employees? Give some specific ideas. Include when you've...

-

Systems thinking is all about solving problemsin organizations, world situations, and even our personal lives. But it is not just a procedure; it is a different way of approaching problems. Our...

-

How would I display the following 3 principles in an entertaining infographic? Be very specific . Principle 1: Employee Engagement and Motivation Drawing from the Human Relations Movement theory and...

-

For the following exercises, determine whether each function is increasing or decreasing. a(x) = 5 2x

-

The tractor is used to lift the 150-kg load B with the 24-mlong rope, boom, and pulley system. If the tractor travels to the right at a constant speed of 4 m/s, determine the tension in the rope when...

-

Should firms behave ethically?

-

The real risk-free rate of interest is 3 percent. Inflation is expected to be 2 percent this year and 4 percent during the next 2 years. Assume that the maturity risk premium is zero. What is the...

-

A Treasury bond that matures in 10 years has a yield of 6 percent. A 10-year corporate bond has a yield of 8 percent. Assume that the liquidity premium on the corporate bond is 0.5 percent. What is...

-

Question 7 of 7 0/14 W PIERDERY Current Attempt in Progress Your answer is incorrect Buffalo Corporation adopted the dollar value LIFO retail inventory method on January 1, 2019. At that time the...

-

Cost of debt with fees . Kenny Enterprises will issue a bond with a par value of $1,000, a maturity of twenty years, and a coupon rate of 9.9% with semiannual payments, and will use an investment...

-

Assume that an investment of $100,000 is expected to grow during the next year by 8% with SD 20%, and that the return is normally distributed. Whats the 5% VaR for the investment? A. $24,898 B....

Study smarter with the SolutionInn App